As

last year, I'll review my past decisions and try to draw some lessons to improve my investing process.

So this is more a top of flop in terms of decisions, than in terms of performance.

The reason, as I explained last year, is that performance is driven by the process but also (at least in the short term) heavily influenced by luck and outside incontrollable factors.

I must also do a post on missed opportunities of which there were many. Let's Gowex (ALGOW) and Burelle (BUR) (both 3 baggers since I looked at them earlier this year, but without buying of course) come to my mind. It certainly isn't pleasant for my ego but I must see if I can improve my decision making here.

I'll review my previous posts more or less in chronological order

CIFE (INFE) : 58 € in

Feb 2011, 50 € end 2011, 45 € end 2012, around 62 € end 2013.

INFE is still cheap because of its extra cash : 68 m€ market cap vs 65m€ NET cash (that stock screeners miss because it's not only in the cash and equivalent section).

However margins are currently paper thin.

The stock still trades at EV/EBIT ~1 even on these depressed margins.

Another issue is that liquidity has dried up.

So top or flop ? Maybe I got caught in a value trap ? I'll have to wait to end of the story to know for sure. But I'm certainly not selling at this low price.

Lesson learned ? maybe the time value of money aspect...undervalued situations can take a looooong time to play out -if ever-

SAM Outillage (SAMP) :

1st article ~32 € in Feb 2011, sold ~45-45 € end 2011. Buyout offer at 38+1.4 € special dividend end 2013 (at P/B~0.8, no intangibles). The float is now very low; a delisting is maybe in the works, probably at the same price.

So a good sell decision.

What made me sell end 2011 ?

I sold at about EV/2010 EBIT ~ 7 but 2010 PER of ~16 and based the following considerations (according to my notes and what I can remember) :

- I was well aware of SAM business characteristics (low margins, cyclical, no concurrential advantage vs other tool makers

- SAMP had a large cash position but had decided to make some major acquisitions, with the associated uncertainties

- and the stock was nearing its highs ("technical analysis", shame on me).

Lesson learned n°1: maybe that "low quality" (not meaning here SAM management, but simply the sector of activity/concurrential position) companies must be bought super cheap and sold cheap. And also maybe not to be blinded by one valuation metric (EV/EBIT in my case): see lesson 2

Lesson learned n°2: SAM net cash has gone from +5.2 m€ end 2010 to -0.4 m€ end 2012 due to new outside companies acquisitions. Sales are up 30% but the net margin has been (for now) divided by 2. A good reminder that extra cash does NOT belong to minority shareholders and I should be careful with that.

Total (FP):

1st article ~32 € August 2011, sold some around 39 € end 2011. Around 45 € end 2013, not counting the hefty dividend. Why did I sell ?

My investment thesis was that I was buying Total for its dividend. My sell decision was inconsistent with that.

Vivendi (VIV):

1st article ~16 € sept 2011, mostly sold around 18 € -19 € recently (see post

here, based on sum of parts analysis).

Some local perspective for foreign readers.

As I feared in my previous post, price war has restarted around 4G offers end of this year (which were supposed to improve the revenue per user of operators). Free mobile said they would offer the 4G for...free with their current subscriptions. Only issue is that their network coverage is very very limited. But the damage (in the customer mind) is done.

Bouygues responded by cutting its 4G subscription prices and I expect Vivendi (SFR) to follow. Inflammatory exchanges in the press. Bouygues CEO threatened to cut Free (Illiad) primary source of income by starting a war on fixed internet prices. Free stock took a 6 % plunge this same day.

Vivendi has sold major divisions, and announced that SFR would be spin (spun ?) off (but at what price ?).

So far I'm still satisfied about my decision. I've kept a small residual line to keep me interested in the company and see how it turns out.

Tessi (TES) :

1st article~62 €, around ~90 € now. Will do a separate article later.

Groupe Crit (CEN) :

1st article ~20 €, averaging down ~14€ and 11€, sold some around 16€. Stock around 31 € now.

So a big nice clear flop.

Lesson learned : taxes !

The apparent tax rate (by that I mean the tax rate calculated frm the income statement and reported in Crit annual reports) has varied widely with time.

The 2009-2010 jump I was aware of ; it was something to do with the calculation of the

CVAE tax, moving from being deducted at the level of the operational result to the net result (or so says the annual report). Crit was trading at a very low EV/EBIT ratio but I was aware of and correcting for this tax effect.

But then (after I sold) the 1HY2013 reports an apparent tax rate of 33% vs 65 % for 2012 ! I suppose that this is linked to the newly installed taxe rebate for low salaries (

CICE). I've not seen an effect so marked for other companies I follow, I think this is related to the nature of Crit business (interim services, lots of (low) salaries, low fixed costs).

Besides the company has apparently done a good job of diversification in the US and the interim services sector has improved.

So clearly my mistake can be classified in the "outside circle of competence" folder ; it's worthwhile to spent more time on the taxes section.

LaCie (LAC):

1st article ~3.5 €, 1st buyout offer from Seagate at 4.05 €, 2nd offer at 4.50 € (I did not sell then either). Seagate has reached the 95 % treshold and the stock has been delisted (compulsory sale for minority shareholders like me) end 2013.

Lesson learned: maybe that a company can be taken private at a low price if there is no strong minority shareholder (mutual fund,...) to protect you.

FFP (FFP):

1st article ~25 €, around 43 € now. At that time my investment thesis was that it was a bet on Peugeot not going belly up with a downside protection guaranteed by the value of the other participations of FFP. Peugeot itself is up 74%, but it's been a wild ride.

I'm quite satisfied with myself on this one. I sold some around 42€, just to trim my exposure. The question of whether there is still upside potential warrants another study and a separate post.

Lesson learned: should do more investing based on balance sheet/sum of parts analysis.

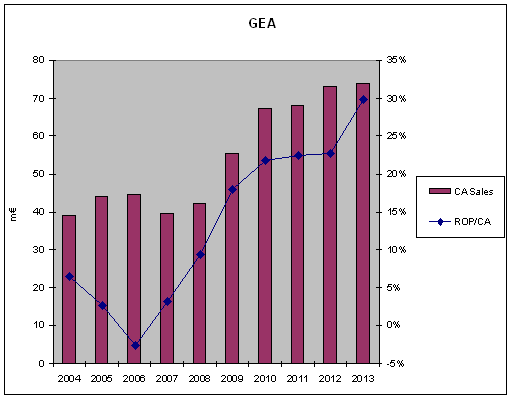

GEA (GEA):

1st article ~65€, around 76 € end 2013. Still trades at EV/EBIT ~ 2. I continue to be puzzled by the stock undervaluation, even if sales and order backlog are quite

volatile. Apparently the minimal financial communication is not very appreciated either (Small caps confidentiel

link). Michel Baulé, a noteworthy entrepreneur turned small/mid cap

investor, now owns 15 % of GEA capital.

Among other buy decisions that have turned out well are IGE+XAO (IGE) or Gerard Perrier Industrie (PERR), both high quality small caps, that I've net yet covered in the blog (but the value and opportunity

blog did).

The post is getting quite long and possibly boring so I'll stop there.

And finally, best wishes to everybody.