1) Intro

The blog as remained silent for a few months, reflecting what I viewed as a relative lack of opportunities.

However small/mid caps have gone down recently.

I want to make an article on IT service companies (acronym: SSII in French).

As usual, I suppose that many readers will think that the article is too long.

However I'm not in a position where I need to pitch my ideas to a time-pressed fund manager.

I'm just running down my checklist.

See wikipedia article on SSII here (in French).

I'll focus this article on SII (SII: the company, not to be confused with SSII), because I have the impression that it's currently one of the cheapest (EV/2014 EBIT~6 for a quote of 7 €, well actually less since I started writing this article, it's now around EV/2014 EBIT ~5)

Is it a real opportunity or a value trap ?

2) Business model

Nate from Oddball stocks has nicely summarized it in a previous article:

"Technical consulting is a very straight-forward business model. A consulting company places a consultant at a client and bills them out at an hourly rate. The consulting company takes a large cut and pays the

remainder to the consultant. As long as a consultant is billing a

client both the employee and consulting company are earning money. If a

client cancels a contract often a consulting company will let the

employee go saving the ongoing expense."

Also the Value and Opportunity blog published a few months ago an interesting article on AKKA (AKA), a direct competitor of SII.

These companies are asset-light, so a potentially interesting return on capital.

They directly benefit from the heavy regulations on the French labor

market ; it's long to fire someone, so client

companies don't hire and prefer to outsource to these service companies, especially for relatively quick changing technologies such as IT.

On the other hand, they are directly exposed to business cycles; the client company can and will quickly cut the contract, especially new projects or if the service company provides a "commodity"-type service, as pointed out on the Value and Opp blog.

I don't work in this sector, so to get an idea I've spent some time exploring French blogs of people working for such companies (not specifically SII) to get an idea. Of course the more vocal are the displeased ones (a common derogatory nickname is 'meat sellers'), so all this needs to be taken with a grain of salt.

Common complaints:

- hiring mainly young engineers, they indirectly benefit form a relatively bad job market for some young graduates (translation: low pay, around 30-35 k€ starting salary)

- no investment (training) in their consultants. Turnover is high. No capitalization of knowledge or know-how

- consultant is left to himself (no or low follow-up) when working at the client site

- when a consultant has no contract, company loses money. So the temptation is high to push this consultant on an available project even if he's not really qualified. Some reports of companies reverting to dirty tricks to pressure consultants to resign to avoid the costs of firing (i.e. repeated missions far from home or much under qualification, pressure to take unpaid vacations between contracts,...).

On the other hand these companies hire a lot, and can offer a variety of professional experiences in different sectors to a young graduate.

Competition and comparables

SII lists itself is main competitors in the annual report:

- divisions of big generalist IT companies (Steria, Sopra,...)

- "big" actors: Akka (AKA), Alten (ATE), Altran (ALT), Assystem (ASY)

- mid size actors: Alyotech, Astek, Ausy (OSI), Segula, SII itself

- small actors: hundreds on local markets or specialized applications.

The global market in France is estimated around 8.8 MM€, very fragmented.

SII estimates its market share around 1%.

I don't think that SII possesses any competitive advantage over its peers.

SII clients are mainly in Aerospace, Telecoms and banking+insurance.

Turnover

SII hired 1400 people last year, on a total of 4400.

Mean age is 34 years, almost nobody over 50. Around 200 job offers on

their site when I looked.

Pretty high

turnover, see above discussion on business model. Also points out on the

vital importance of correctly anticipating new staff requirements in

function the business outlook.

3) Financials

Balance sheet

SII finishes it year on 31 march.

LT debt 6 m€; short term debt 10 m€, around 28 m€ cash => 12 m€ net cash

Asset light (only 7 m€ fixed tangible assets vs 81 m€ equity ; 17 m€ of fixed intangible assets -mainly goodwill and capitalized R&D costs).

Working capital

114 m€ receivables + 14 m€ other receivables - 62 m€ operating debt (suppliers, social security,...) = 66 m€ working capital, quite significant (66 m€ /294 m€ annual sales => 80 days).

Consultants are paid monthly but I guess that clients are much slower to pay.

SII operates not only on hourly rate contracts (technical assistance) but also on fixed price projects ("forfait", around 22% of 2014 sales). These projects carry an additional execution risk.

For instance working capital requirement has increased in 2014 even though sales are almost flat. SII explains that they haven't billed yet 5.4 m€ on a project in Spain.

2014 return on capital = 21 m€ operating result (after non recurrent items) x (1-34% tax rate, more on that later)/ (66 working capital + 7 m€ fixed tangible assets) ~around 20 %.

Pretty good, especially if trading at ~6 times trailing EBIT.

(Market cap 135 m€, using 18.5 m shares)

But why is it cheap ?

Income statement

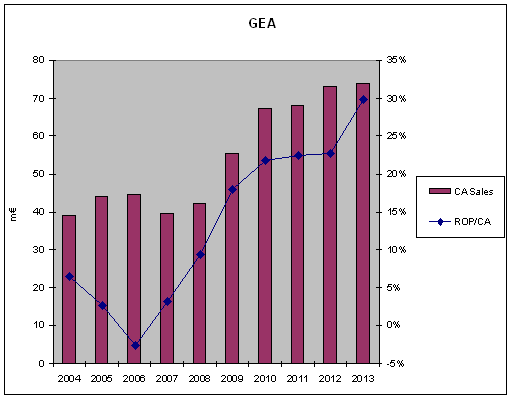

Sales and EBIT (after depreciation) margins.

Operational margins went down in 2009-2010, just after the crisis. SII attributes this to the price pressure on technical assistance contracts, and the time needed to adjust its hiring to new conditions.

Since 2010, SII faces a slow business environment in France (pressure on prices in telecoms, reduced defense spending, end of Airbus A350/A380 program development,...), but operational margins seem to be stabilized.

Around 12%-13% annual growth over the last years, and going back to SII IPO in 1999, growth is pretty impressive.

What is the source of this growth ? Organic or based on acquisitions ?

Unfortunately SII does not provide this information in its annual report (or I've missed it) so I've used what I've found in the analyst presentations.

A recent external acquisition is Rücker Aerospace in Germany. AKKA is also investing in Germany, I wonder if it's a coincidence or if there's some underlying common reason.

SII has a opened a number of branches and international growth seems impressive (double digit).

To sum it up, it does not seem to me that SII is a "serial acquirer" with the associated risks. There's about 11m€ goodwill, compared to 183 m€ total assets.

Taxes and CVAE

I've learned my lesson with my Group Crit failure on this one.

Here is a graph giving the "apparent" tax rate (income taxes/EBIT).

The CVAE tax was deducted from the operational result before 2012. Recently the CICE has made its apparition. Messy. I'll take an average tax rate of 34%.

Where goes the cash ?

Definitions

CAF = capacite d'autofinancement = cash flow

BFR = variation du besoin en fonds de roulement = change in working capital

flux exploit = cash flow from operations, taken from statement from cash flow

CAPEX = investment in fixed assets

FCF = cash flow from operations - CAPEX

The big drop in 2012 is linked to taxes.

What to make of this ?

Well my interpretation is that these companies are maybe asset and CAPEX-light, but need a large (and growing) working capital. So SII growth is not accompanied by a very large FCF generation.

Capitalized R&D costs

Apparently there's 7 m€ capitalized R&D costs on the balance sheet, mainly linked to software developped by a subsidiary named Concatel in Spain. I'm unsure and wary about the effect of capitalized R&D costs on the operational result, but in SII case it seems relatively secondary.

4) Shareholder structure and management

Who owns the capital

The founder family (Bernard Huvé) owns 55%, Fidelity 8%, Oddo Asset Management 5 %. Only 16% float. Fidelity had previously declared to have crossed the 10 % treshold in september 2013, so they've apparently sold some shares ?

Bernard Huvé stepped down from its operational functions in 2007; the current manager is Eric Matteucci, an internal promotion.

Theoretically, as a minority investor my interests are aligned with the founding family (no excessive risk taking, no major dilution, no excessive stock options for managers), except for the risk of squeeze-out at a low price. The presence of Fidelity and Oddo is quite reassuring on this point.

Another potential issue is when the main shareholder manages to catch a good part of profits before it gets to the bottom line. The founder salary is around 70 k€ in 2014, quite low. No other indirect compensation found in the "conventions reglementees" (regulated agreements and comitments) section.

Management

Is the management renumeration aligned with the shareholders interests ?

The 3 top managers earned around 400 k€ each last year. No golden parachute or retirement package. No "special conventions". The determination of the variable part is not disclosed for "confidentiality reasons".

Dilution due to stock options

20 m shares, around 300 k shares in stock options and free shares for managers, minus 1.8 m shares owned by the company itself.

If I understand correctly, around 150 k free shares + 150 k performance

related shares have been issued this year => 300 k shares =>

around 1.5% annual dilution.

However looking into the past dilution was more significant (up to 800 k potential shares in 2010...).

There is no apparent dilution, because SII buys back and cancels shares to offset stock options and free shares. If I understand correctly the annual report, 700 k€ have been charged in 2013-2014 to shareholders to offset this dilution, which is

not unsignificant relative to FCF.

5) Valuation

Relative valuation

Comparison table (I'm not sure about my Assystem numbers because of the recent financial operations, convertible bonds and the associated potential dilution)

At the beginning of this year, Assystem offered a buyout to minority shareholders.

The following table is extracted from the independent expert report.

So SII appears to be somewhat cheaper than its competitors.

This discount can maybe explained by some size effect, maybe in combination with the relatively low liquidity of the stock.

Also SII sales/people ratio is the lower of this sample. I have no explanation for his and wonder how they manage to have an operating margin in the mean.

Historical valuation

I've used approx high/low prices for each year. Looks that SII valuation has always been quite low.

6) Tying it up all together

I don't think that SII has any competitive advantage over its peers.

Likewise, we're not talking about a high-quality or a "moat" business situation. I don't think that SII clients can incur high switching costs.

On the other hand, SII valuation appears quite low in absolute terms, given the respectable return and growth, the robust balance sheet, and an apparent resilience in the crisis years.

SII is also somewhat cheaper than its comparables (especially around 5x EBIT).

Historically, SII valuation has always been quite low.

So maybe SII is doomed to remain eternally cheap, for some reason

that escapes me but not Mr Market (maybe I'm underestimating the

cyclicality of the business, or the liquidity/size effect).

I bought my 1st shares around 4 € in feb 2013 and some more during the recent downturn.

Maybe it's yet another value trap I've fallen in, however I'm willing to take this risk, which seems moderate to me.

As usual , feedback welcome.

Investissement avec un biais "Value" et petites capitalisations. Value and small caps investing in France.

mardi 28 octobre 2014

vendredi 30 mai 2014

GEA HY14 results

1) Intro

Note that the article is not self-supporting and will not make sense to a new reader (see my previous articles here 2012 , 2013).

GEA has published it's 2013 annual report and its 1stHY report:

- in the annual report the CEO warns clearly about a marked slowdown of sales in France, the need to focus on export markets, albeit at the cost of significant commercial investments and financial risks

- the CEO warns that it may impact profit margins

- 1stHY sales are down 25% compared to last year; down 50% in France, exports up 38%

- order book sharply down

I want to build a "worst case" scenario to decide what to do.

Besides, I previously compared GEA to Kapsch but Q-Free is maybe a better match (same size; Kapsch is much bigger, and builds but also operates whole/nationwide toll collection systems, a different business).

Q-Free 2013 revenue is the same as GEA.

2) What are GEA fixed costs ?

My current understanding of GEA business and financial situation is as follows:

- GEA designs the toll system (~100 engineers)

- I think it uses largely standard, off-the-shelf components (PLC, printers, card readers, audio and video systems, network components; fabrication of toll steel boxes is subcontracted, maybe they direcly manufacture some dedicated electronic cards) ; it's mainly integration and assembly, so no heavy equipment is needed (see below fixed assets). I wish I had the time to visit their plant near Grenoble.

- ~100 people directly involved in production

- factory tests

- on-site installation

- maintenance and services

I think that if a downturn comes, GEA will be reluctant to significantly downsize its personnel (temporary staff aside) because:

- it would jeopardize future growth; GEA says in its annual report that the competence and stability of its people is important

- (supposition) not the style of this family-owned small company that thinks long term and not next year stock-options

- anyway long and costly (France labor market).

My main hypothesis is therefore that GEA has mainly variable costs, but that personnel expenses can be regarded as fixed costs, and it's a big part of expenses.

3) 2014 estimates

I've built the estimates with the preceding paragraph in mind and the following hypothesis:

- salaries: fixed cost

- all the rest: variable cost (not true of course)

- 1st hypothesis of 2014 sales~59 m€ (roughly double HY sales)

- 2nd hypothesis of 2014 sales~47 m€ (current order backlog)

- hypothesis that they will not needlessly build up their inventory and other costs

- I neglected amortization+depreciation in this simplified table, it's acceptable because it's generally low (see below)

Here is a table with data taken from the annual reports with my estimates.

Mat1ere = shorthand for "raw materials" expenses (in this case rather parts, components,...)

Autres achats = other expenses (go figure....)

Salaires = salaries

ROP = Operational result

I get a 2014 EBIT ~9-10 m€ in the (worst-case ?) scenario, a spectacular decrease compared to 2013.

But it would then trade at ~4 to 5x EBIT (for a quote of 87€), still a compelling valuation (because of the large net cash 60m€ for a 100 m€ market cap).

3) GEA competitive advantage

I've recently read this book The Little Book That Builds Wealth: The Knockout Formula for Finding Great Investments and liked it a lot; I will try to apply its concepts/ideas to the current situation.

and liked it a lot; I will try to apply its concepts/ideas to the current situation.

GEA fixed assets are only ~ 1.2 m€ almost fully depreciated.

Much lower than Q-Free fixed assets though (see below). I have no explication for this.

It rents its buildings to another company...that belongs to the founding family/main shareholder, for what seems to me a reasonable price (see annual report).

Working capital is also very low; GEA pays its suppliers 30/60 days and negotiates payment terms with the customer (highway companies).

I've kept the actual denominations of the annual report (French version) for easy later reference.

Mat. 1ere = raw materials

en cours = inventory

creances clients = accounts receivable

dettes fournisseurs = accounts payable

dettes fiscales = fiscal debt

produits constates d'avance = prepaid income

BFR = working capital requirement

The capital employed (fixed assets + working capital) is thus very low.

About 5% of salaries can be considered as R&D costs, but are fully expended (R&D is not capitalized).

If I take assets at acquisition cost, add 5 years of R&D costs (arbritrary), ROCE is still very high.

Why is it not competed away ?

My understanding is that "local" actors (GEA in France, Q-Free in Norway, Kapsch in Austria,...) started early and small and ended dominating their national market (niche market).

I suspect that some kind of switching cost effect is at work there; for the highway company these actors provide a vital service, strongly integrated in the highway company process.

(Imagine the toll collection system down during summer vacations in southern France when half of Europe is en route from Netherlands/Germany/... to Italy/Spain/France...)

Besides from what I've read electronic toll collection investment pays for itself in less than 1 year.

So it makes probably little sense for a highway company to switch its ETC system from one to supplier to a cheaper competitor, unless there's a large price difference. Given the (small) size of the market, it's not just worth it for a competitor (again, a supposition). Additionally there is maybe (supposition) some notion of staff training (highway employees trained to do some basic maintenance on the toll machines) that reinforces this.

GEA benefited from this competitive advantage and an expanding market in France for structural reasons (highways companies going private investment cycle, see my previous article) but it is now apparently nearing saturation.

On the export markets, for new highways, I think that GEA has no clear competitive advantage (GEA "moat" is not scalable, lots of buzzwords here). Their strategy seems to accompany French construction companies (Bouygues, Vinci,...) on export contracts for new highways (see annual reports and also the red corner blog comments on GEA), but its unclear to me if it gives them some kind of commercial advantage on these markets.

5) Conclusion

I don't want to fool myself, and I'm the easiest person to fool.

I like GEA and I have invested some time (and money) in this investment, but I want to remain cold and rational about this.

I'm certaintly not selling GEA at the current price.

I think a downturn is possible, but I think GEA is still an interesting investment with good long term prospects and favorable economics.

The stock is quite illiquid, and we may (or not) witness a spectular plunge if there's a knee-jerk reaction to weak HY results, maybe a buying opportunity.

I'd appreciate a reality check from outside investors.

Note that the article is not self-supporting and will not make sense to a new reader (see my previous articles here 2012 , 2013).

GEA has published it's 2013 annual report and its 1stHY report:

- in the annual report the CEO warns clearly about a marked slowdown of sales in France, the need to focus on export markets, albeit at the cost of significant commercial investments and financial risks

- the CEO warns that it may impact profit margins

- 1stHY sales are down 25% compared to last year; down 50% in France, exports up 38%

- order book sharply down

I want to build a "worst case" scenario to decide what to do.

Besides, I previously compared GEA to Kapsch but Q-Free is maybe a better match (same size; Kapsch is much bigger, and builds but also operates whole/nationwide toll collection systems, a different business).

Q-Free 2013 revenue is the same as GEA.

2) What are GEA fixed costs ?

My current understanding of GEA business and financial situation is as follows:

- GEA designs the toll system (~100 engineers)

- I think it uses largely standard, off-the-shelf components (PLC, printers, card readers, audio and video systems, network components; fabrication of toll steel boxes is subcontracted, maybe they direcly manufacture some dedicated electronic cards) ; it's mainly integration and assembly, so no heavy equipment is needed (see below fixed assets). I wish I had the time to visit their plant near Grenoble.

- ~100 people directly involved in production

- factory tests

- on-site installation

- maintenance and services

I think that if a downturn comes, GEA will be reluctant to significantly downsize its personnel (temporary staff aside) because:

- it would jeopardize future growth; GEA says in its annual report that the competence and stability of its people is important

- (supposition) not the style of this family-owned small company that thinks long term and not next year stock-options

- anyway long and costly (France labor market).

My main hypothesis is therefore that GEA has mainly variable costs, but that personnel expenses can be regarded as fixed costs, and it's a big part of expenses.

3) 2014 estimates

I've built the estimates with the preceding paragraph in mind and the following hypothesis:

- salaries: fixed cost

- all the rest: variable cost (not true of course)

- 1st hypothesis of 2014 sales~59 m€ (roughly double HY sales)

- 2nd hypothesis of 2014 sales~47 m€ (current order backlog)

- hypothesis that they will not needlessly build up their inventory and other costs

- I neglected amortization+depreciation in this simplified table, it's acceptable because it's generally low (see below)

Here is a table with data taken from the annual reports with my estimates.

Mat1ere = shorthand for "raw materials" expenses (in this case rather parts, components,...)

Autres achats = other expenses (go figure....)

Salaires = salaries

ROP = Operational result

But it would then trade at ~4 to 5x EBIT (for a quote of 87€), still a compelling valuation (because of the large net cash 60m€ for a 100 m€ market cap).

3) GEA competitive advantage

I've recently read this book The Little Book That Builds Wealth: The Knockout Formula for Finding Great Investments

GEA fixed assets are only ~ 1.2 m€ almost fully depreciated.

Much lower than Q-Free fixed assets though (see below). I have no explication for this.

It rents its buildings to another company...that belongs to the founding family/main shareholder, for what seems to me a reasonable price (see annual report).

Working capital is also very low; GEA pays its suppliers 30/60 days and negotiates payment terms with the customer (highway companies).

I've kept the actual denominations of the annual report (French version) for easy later reference.

Mat. 1ere = raw materials

en cours = inventory

creances clients = accounts receivable

dettes fournisseurs = accounts payable

dettes fiscales = fiscal debt

produits constates d'avance = prepaid income

BFR = working capital requirement

The capital employed (fixed assets + working capital) is thus very low.

About 5% of salaries can be considered as R&D costs, but are fully expended (R&D is not capitalized).

If I take assets at acquisition cost, add 5 years of R&D costs (arbritrary), ROCE is still very high.

Why is it not competed away ?

My understanding is that "local" actors (GEA in France, Q-Free in Norway, Kapsch in Austria,...) started early and small and ended dominating their national market (niche market).

I suspect that some kind of switching cost effect is at work there; for the highway company these actors provide a vital service, strongly integrated in the highway company process.

(Imagine the toll collection system down during summer vacations in southern France when half of Europe is en route from Netherlands/Germany/... to Italy/Spain/France...)

Besides from what I've read electronic toll collection investment pays for itself in less than 1 year.

So it makes probably little sense for a highway company to switch its ETC system from one to supplier to a cheaper competitor, unless there's a large price difference. Given the (small) size of the market, it's not just worth it for a competitor (again, a supposition). Additionally there is maybe (supposition) some notion of staff training (highway employees trained to do some basic maintenance on the toll machines) that reinforces this.

GEA benefited from this competitive advantage and an expanding market in France for structural reasons (highways companies going private investment cycle, see my previous article) but it is now apparently nearing saturation.

On the export markets, for new highways, I think that GEA has no clear competitive advantage (GEA "moat" is not scalable, lots of buzzwords here). Their strategy seems to accompany French construction companies (Bouygues, Vinci,...) on export contracts for new highways (see annual reports and also the red corner blog comments on GEA), but its unclear to me if it gives them some kind of commercial advantage on these markets.

5) Conclusion

I don't want to fool myself, and I'm the easiest person to fool.

I like GEA and I have invested some time (and money) in this investment, but I want to remain cold and rational about this.

I'm certaintly not selling GEA at the current price.

I think a downturn is possible, but I think GEA is still an interesting investment with good long term prospects and favorable economics.

The stock is quite illiquid, and we may (or not) witness a spectular plunge if there's a knee-jerk reaction to weak HY results, maybe a buying opportunity.

I'd appreciate a reality check from outside investors.

vendredi 24 janvier 2014

GEA 2013 annual results

GEA published yesterday evening its annual results : link (in French only).

The presentation slides are interesting to get an idea of GEA business.

Previous posts on GEA: here and here.

The stock went up sharply today (+15%, 88.4 €).

A few comments

Sales are flat ; EBIT margin (operational margin to be precise) is up but GEA warns that it is exceptional and linked to the end of several contracts.

The drop in backlog orders has -so far- not materialized itself. There's nothing in the press release or in the slides hinting at a future drop in sales ; the management insists on its export recent contracts. GEA does not seem to be much affected by the Ecotaxe Snafu.

The cash is boosted by a reduction of the working capital that was already apparent in the 2013HY accounts ; so again a one-off effect.

True to itself the management has decided to keep the cash to "stay independent" and "finance its investments and exports". However the dividend is up 40% (3.35 €/share).

The family owns 38 % of the capital. Michel Baule, an entrepreneur in polymers turned small caps investor, owns 15%. I see his presence (strong minority investor) as a positive development.

With 60 m€ net cash for a 106 m€ market cap, EV/2013 EBIT ~ 2 !

I see no excuse not to buy some more (and I did at the opening this morning).

A look at competitor Kapsch :

I did not spent enough time on this, but from what I understand the project-related part of the business can be quite volatile (problems in Poland and South Africa legal issues). So a good reminder that a mindless extrapolation of the past performance is dangerous...I guess it applies to GEA also.

The presentation slides are interesting to get an idea of GEA business.

Previous posts on GEA: here and here.

The stock went up sharply today (+15%, 88.4 €).

A few comments

Sales are flat ; EBIT margin (operational margin to be precise) is up but GEA warns that it is exceptional and linked to the end of several contracts.

The drop in backlog orders has -so far- not materialized itself. There's nothing in the press release or in the slides hinting at a future drop in sales ; the management insists on its export recent contracts. GEA does not seem to be much affected by the Ecotaxe Snafu.

The cash is boosted by a reduction of the working capital that was already apparent in the 2013HY accounts ; so again a one-off effect.

True to itself the management has decided to keep the cash to "stay independent" and "finance its investments and exports". However the dividend is up 40% (3.35 €/share).

The family owns 38 % of the capital. Michel Baule, an entrepreneur in polymers turned small caps investor, owns 15%. I see his presence (strong minority investor) as a positive development.

With 60 m€ net cash for a 106 m€ market cap, EV/2013 EBIT ~ 2 !

I see no excuse not to buy some more (and I did at the opening this morning).

A look at competitor Kapsch :

I did not spent enough time on this, but from what I understand the project-related part of the business can be quite volatile (problems in Poland and South Africa legal issues). So a good reminder that a mindless extrapolation of the past performance is dangerous...I guess it applies to GEA also.

mercredi 8 janvier 2014

2013 review : tops and flops

As last year, I'll review my past decisions and try to draw some lessons to improve my investing process.

So this is more a top of flop in terms of decisions, than in terms of performance.

The reason, as I explained last year, is that performance is driven by the process but also (at least in the short term) heavily influenced by luck and outside incontrollable factors.

I must also do a post on missed opportunities of which there were many. Let's Gowex (ALGOW) and Burelle (BUR) (both 3 baggers since I looked at them earlier this year, but without buying of course) come to my mind. It certainly isn't pleasant for my ego but I must see if I can improve my decision making here.

I'll review my previous posts more or less in chronological order

CIFE (INFE) : 58 € in Feb 2011, 50 € end 2011, 45 € end 2012, around 62 € end 2013.

INFE is still cheap because of its extra cash : 68 m€ market cap vs 65m€ NET cash (that stock screeners miss because it's not only in the cash and equivalent section).

However margins are currently paper thin.

The stock still trades at EV/EBIT ~1 even on these depressed margins.

Another issue is that liquidity has dried up.

So top or flop ? Maybe I got caught in a value trap ? I'll have to wait to end of the story to know for sure. But I'm certainly not selling at this low price.

Lesson learned ? maybe the time value of money aspect...undervalued situations can take a looooong time to play out -if ever-

SAM Outillage (SAMP) : 1st article ~32 € in Feb 2011, sold ~45-45 € end 2011. Buyout offer at 38+1.4 € special dividend end 2013 (at P/B~0.8, no intangibles). The float is now very low; a delisting is maybe in the works, probably at the same price.

So a good sell decision.

What made me sell end 2011 ?

I sold at about EV/2010 EBIT ~ 7 but 2010 PER of ~16 and based the following considerations (according to my notes and what I can remember) :

- I was well aware of SAM business characteristics (low margins, cyclical, no concurrential advantage vs other tool makers

- SAMP had a large cash position but had decided to make some major acquisitions, with the associated uncertainties

- and the stock was nearing its highs ("technical analysis", shame on me).

Lesson learned n°1: maybe that "low quality" (not meaning here SAM management, but simply the sector of activity/concurrential position) companies must be bought super cheap and sold cheap. And also maybe not to be blinded by one valuation metric (EV/EBIT in my case): see lesson 2

Lesson learned n°2: SAM net cash has gone from +5.2 m€ end 2010 to -0.4 m€ end 2012 due to new outside companies acquisitions. Sales are up 30% but the net margin has been (for now) divided by 2. A good reminder that extra cash does NOT belong to minority shareholders and I should be careful with that.

Total (FP): 1st article ~32 € August 2011, sold some around 39 € end 2011. Around 45 € end 2013, not counting the hefty dividend. Why did I sell ?

My investment thesis was that I was buying Total for its dividend. My sell decision was inconsistent with that.

Vivendi (VIV): 1st article ~16 € sept 2011, mostly sold around 18 € -19 € recently (see post here, based on sum of parts analysis).

Some local perspective for foreign readers.

As I feared in my previous post, price war has restarted around 4G offers end of this year (which were supposed to improve the revenue per user of operators). Free mobile said they would offer the 4G for...free with their current subscriptions. Only issue is that their network coverage is very very limited. But the damage (in the customer mind) is done.

Bouygues responded by cutting its 4G subscription prices and I expect Vivendi (SFR) to follow. Inflammatory exchanges in the press. Bouygues CEO threatened to cut Free (Illiad) primary source of income by starting a war on fixed internet prices. Free stock took a 6 % plunge this same day.

Vivendi has sold major divisions, and announced that SFR would be spin (spun ?) off (but at what price ?).

So far I'm still satisfied about my decision. I've kept a small residual line to keep me interested in the company and see how it turns out.

Tessi (TES) : 1st article~62 €, around ~90 € now. Will do a separate article later.

Groupe Crit (CEN) : 1st article ~20 €, averaging down ~14€ and 11€, sold some around 16€. Stock around 31 € now.

So a big nice clear flop.

Lesson learned : taxes !

The apparent tax rate (by that I mean the tax rate calculated frm the income statement and reported in Crit annual reports) has varied widely with time.

The 2009-2010 jump I was aware of ; it was something to do with the calculation of the CVAE tax, moving from being deducted at the level of the operational result to the net result (or so says the annual report). Crit was trading at a very low EV/EBIT ratio but I was aware of and correcting for this tax effect.

But then (after I sold) the 1HY2013 reports an apparent tax rate of 33% vs 65 % for 2012 ! I suppose that this is linked to the newly installed taxe rebate for low salaries (CICE). I've not seen an effect so marked for other companies I follow, I think this is related to the nature of Crit business (interim services, lots of (low) salaries, low fixed costs).

Besides the company has apparently done a good job of diversification in the US and the interim services sector has improved.

So clearly my mistake can be classified in the "outside circle of competence" folder ; it's worthwhile to spent more time on the taxes section.

LaCie (LAC): 1st article ~3.5 €, 1st buyout offer from Seagate at 4.05 €, 2nd offer at 4.50 € (I did not sell then either). Seagate has reached the 95 % treshold and the stock has been delisted (compulsory sale for minority shareholders like me) end 2013.

Lesson learned: maybe that a company can be taken private at a low price if there is no strong minority shareholder (mutual fund,...) to protect you.

FFP (FFP): 1st article ~25 €, around 43 € now. At that time my investment thesis was that it was a bet on Peugeot not going belly up with a downside protection guaranteed by the value of the other participations of FFP. Peugeot itself is up 74%, but it's been a wild ride.

I'm quite satisfied with myself on this one. I sold some around 42€, just to trim my exposure. The question of whether there is still upside potential warrants another study and a separate post.

Lesson learned: should do more investing based on balance sheet/sum of parts analysis.

GEA (GEA): 1st article ~65€, around 76 € end 2013. Still trades at EV/EBIT ~ 2. I continue to be puzzled by the stock undervaluation, even if sales and order backlog are quite volatile. Apparently the minimal financial communication is not very appreciated either (Small caps confidentiel link). Michel Baulé, a noteworthy entrepreneur turned small/mid cap investor, now owns 15 % of GEA capital.

Among other buy decisions that have turned out well are IGE+XAO (IGE) or Gerard Perrier Industrie (PERR), both high quality small caps, that I've net yet covered in the blog (but the value and opportunity blog did).

The post is getting quite long and possibly boring so I'll stop there.

And finally, best wishes to everybody.

So this is more a top of flop in terms of decisions, than in terms of performance.

The reason, as I explained last year, is that performance is driven by the process but also (at least in the short term) heavily influenced by luck and outside incontrollable factors.

I must also do a post on missed opportunities of which there were many. Let's Gowex (ALGOW) and Burelle (BUR) (both 3 baggers since I looked at them earlier this year, but without buying of course) come to my mind. It certainly isn't pleasant for my ego but I must see if I can improve my decision making here.

I'll review my previous posts more or less in chronological order

CIFE (INFE) : 58 € in Feb 2011, 50 € end 2011, 45 € end 2012, around 62 € end 2013.

INFE is still cheap because of its extra cash : 68 m€ market cap vs 65m€ NET cash (that stock screeners miss because it's not only in the cash and equivalent section).

However margins are currently paper thin.

The stock still trades at EV/EBIT ~1 even on these depressed margins.

Another issue is that liquidity has dried up.

So top or flop ? Maybe I got caught in a value trap ? I'll have to wait to end of the story to know for sure. But I'm certainly not selling at this low price.

Lesson learned ? maybe the time value of money aspect...undervalued situations can take a looooong time to play out -if ever-

SAM Outillage (SAMP) : 1st article ~32 € in Feb 2011, sold ~45-45 € end 2011. Buyout offer at 38+1.4 € special dividend end 2013 (at P/B~0.8, no intangibles). The float is now very low; a delisting is maybe in the works, probably at the same price.

So a good sell decision.

What made me sell end 2011 ?

I sold at about EV/2010 EBIT ~ 7 but 2010 PER of ~16 and based the following considerations (according to my notes and what I can remember) :

- I was well aware of SAM business characteristics (low margins, cyclical, no concurrential advantage vs other tool makers

- SAMP had a large cash position but had decided to make some major acquisitions, with the associated uncertainties

- and the stock was nearing its highs ("technical analysis", shame on me).

Lesson learned n°1: maybe that "low quality" (not meaning here SAM management, but simply the sector of activity/concurrential position) companies must be bought super cheap and sold cheap. And also maybe not to be blinded by one valuation metric (EV/EBIT in my case): see lesson 2

Lesson learned n°2: SAM net cash has gone from +5.2 m€ end 2010 to -0.4 m€ end 2012 due to new outside companies acquisitions. Sales are up 30% but the net margin has been (for now) divided by 2. A good reminder that extra cash does NOT belong to minority shareholders and I should be careful with that.

Total (FP): 1st article ~32 € August 2011, sold some around 39 € end 2011. Around 45 € end 2013, not counting the hefty dividend. Why did I sell ?

My investment thesis was that I was buying Total for its dividend. My sell decision was inconsistent with that.

Vivendi (VIV): 1st article ~16 € sept 2011, mostly sold around 18 € -19 € recently (see post here, based on sum of parts analysis).

Some local perspective for foreign readers.

As I feared in my previous post, price war has restarted around 4G offers end of this year (which were supposed to improve the revenue per user of operators). Free mobile said they would offer the 4G for...free with their current subscriptions. Only issue is that their network coverage is very very limited. But the damage (in the customer mind) is done.

Bouygues responded by cutting its 4G subscription prices and I expect Vivendi (SFR) to follow. Inflammatory exchanges in the press. Bouygues CEO threatened to cut Free (Illiad) primary source of income by starting a war on fixed internet prices. Free stock took a 6 % plunge this same day.

Vivendi has sold major divisions, and announced that SFR would be spin (spun ?) off (but at what price ?).

So far I'm still satisfied about my decision. I've kept a small residual line to keep me interested in the company and see how it turns out.

Tessi (TES) : 1st article~62 €, around ~90 € now. Will do a separate article later.

Groupe Crit (CEN) : 1st article ~20 €, averaging down ~14€ and 11€, sold some around 16€. Stock around 31 € now.

So a big nice clear flop.

Lesson learned : taxes !

The apparent tax rate (by that I mean the tax rate calculated frm the income statement and reported in Crit annual reports) has varied widely with time.

The 2009-2010 jump I was aware of ; it was something to do with the calculation of the CVAE tax, moving from being deducted at the level of the operational result to the net result (or so says the annual report). Crit was trading at a very low EV/EBIT ratio but I was aware of and correcting for this tax effect.

But then (after I sold) the 1HY2013 reports an apparent tax rate of 33% vs 65 % for 2012 ! I suppose that this is linked to the newly installed taxe rebate for low salaries (CICE). I've not seen an effect so marked for other companies I follow, I think this is related to the nature of Crit business (interim services, lots of (low) salaries, low fixed costs).

Besides the company has apparently done a good job of diversification in the US and the interim services sector has improved.

So clearly my mistake can be classified in the "outside circle of competence" folder ; it's worthwhile to spent more time on the taxes section.

LaCie (LAC): 1st article ~3.5 €, 1st buyout offer from Seagate at 4.05 €, 2nd offer at 4.50 € (I did not sell then either). Seagate has reached the 95 % treshold and the stock has been delisted (compulsory sale for minority shareholders like me) end 2013.

Lesson learned: maybe that a company can be taken private at a low price if there is no strong minority shareholder (mutual fund,...) to protect you.

FFP (FFP): 1st article ~25 €, around 43 € now. At that time my investment thesis was that it was a bet on Peugeot not going belly up with a downside protection guaranteed by the value of the other participations of FFP. Peugeot itself is up 74%, but it's been a wild ride.

I'm quite satisfied with myself on this one. I sold some around 42€, just to trim my exposure. The question of whether there is still upside potential warrants another study and a separate post.

Lesson learned: should do more investing based on balance sheet/sum of parts analysis.

GEA (GEA): 1st article ~65€, around 76 € end 2013. Still trades at EV/EBIT ~ 2. I continue to be puzzled by the stock undervaluation, even if sales and order backlog are quite volatile. Apparently the minimal financial communication is not very appreciated either (Small caps confidentiel link). Michel Baulé, a noteworthy entrepreneur turned small/mid cap investor, now owns 15 % of GEA capital.

Among other buy decisions that have turned out well are IGE+XAO (IGE) or Gerard Perrier Industrie (PERR), both high quality small caps, that I've net yet covered in the blog (but the value and opportunity blog did).

The post is getting quite long and possibly boring so I'll stop there.

And finally, best wishes to everybody.

Inscription à :

Articles (Atom)