Summary

CNIM has released yestersday its HY2015 results (in French only, for the moment, but CNIM has an english version of its website).

HY results are good and valuation is rather attractive on the basis of trailing earnings (EV/2014 EBIT ~ 4).

Stock is up 5% in 2 days, notwithstanding Monday declining overall market.

However I'm not convinced that the valuation is so attractive, considering the outlook, and would prefer a larger margin of safety.

Intro

CNIM is an industrial company operating in 3 sectors:

- environment: mainly construction of waste to energy plants (WTE), operation of WTE plants, some moves towards solar energy (thermal conversion, not photovoltaic)

- "systems": defense (missile launch, sea landing,..), nuclear components, engineering (Bertin subsidiary)

- energy: industrial boilers (maintenance,..)

~ 2800 employees, 2014 sales ~ 800 m€. Market cap ~ 220 m€

A good overall presentation of CNIM has been made here (Value uncovered 2012 post, in English)

See also fininfohub 2014 post on the annual results analyst presentation (in English)

The stock currently trades at a low valuation (76€ when article was written, EV/2014 EBIT ~ 4, ~7% dividend yield) and shows a good historic record of profitability. Strong balance sheet (excess cash 46 m€).

FCF varies a lot because of the changes in working capital requirements linked to the construction contracts payment terms.

Why is it cheap ? Is it a real undervaluation ? Link to value and opportunity recent post on the exact same topic : "Cheap for a reason".

Several possible answers :

1. Forgotten sector/company, etc...

Possible.

CNIM is not followed by any analyst , as far as I know.

However, liquidity is reasonnable. CNIM is not a "micro-cap" at least on French market standards, and I think that some small cap/value funds are certainly well aware of CNIM.

2. Bad outlook

"Systems" activity suffers from governement budget cuts. Among other things, CNIM makes landing barges for Mistral-class military ships. I'm not sure if the cancellation of the Russian purchase has not affected indirectly CNIM.

Business journal "Les Echos" made this summer an article (in French) on technical unemployment for 510 people (2/3 of the total) in some CNIM plants (mainly in the "systems" division) due to reduced activity. Translation of the title: "CNIM group suffers from an unprecedented reduced backlog in defense and environment".

Sales and backlog (data from annual reports) illustrate this:

What bothers me is the environment sector, the only one making serious money currently.

I've made some (not enough) research on the WTE market.

Some articles of interest :

An article from Johannes Martin of Martin GmbH which supplies key components (moving grates on which the waste is burned) and a long-time (50 years) industrial partner of CNIM. We'll get back to Herr Martin later.

Summary: saturated market. British market was strong recently.

Another article from "Waste management world"

Explains that EU law on landfills (higher standard for landfill sites) is the driving force behind the construction of WTE plants. Overcapacity in Germany and Northern Europe (some countries import waste to be burned!), dynamic UK market, some distant prospects in South/Eastern Europe. Some perspectives on modernization of old units.

I've noted that recent CNIM contracts for WTE plants are in the UK so it is consistent with this article.

The article also states that southern Europe (including France) "have not yet involved into major markets for WTE" but this is inconsistent (at least for France) with this 2012 map of european WTE plants.

This presentation from J. Martin is also intersesting and gives a worldwide perspective (warning: 8 Mo pdf file).

Scuttlebutt: I currently live not far from Marseilles. The implantation of a much-needed waste incinerator has been met with a fierce opposition from local associations and associated legal battles (NIMBY syndrome). In the above article of "Les Echos", it is also noted that CNIM had been awarded the contract for the modernization of a 40 year-old WTE plant in France, but the contract has been suspended after locals have opposed it.

So to sum it up my interpretation is that the recent good results for CNIM are mainly linked to the UK WTE market, and that it is not reasonnable to extrapolate these recent results.

3. 2014 Buyout

In 2014 CNIM made a tender offer :

- 30 € special dividend

- 75 € tender offer (after the special dividend)

Some major shareholders sold their share, including Martin GmbH (10% of capital) and CNN, a shipowner company (20%) previously associated with CNIM.

So CNIM is now fully controlled by the Dmitirieff family.

I've found no explanation why Martin GmbH or CNN sold their shares. So I must conclude that the price offered was judged fair by these sophisticated investors, and the current price offers no discount.

The tender offer documentation is available here (in French).

I found the following information interesting in the independant auditor report:

- according to the business plan, for the environnemnt division, weaker sales are expected (end of UK orders), with a rebound later (hypothesis of sales in the middle-east), EBITDA margin higher in 2014, lower in 2015 and 2016

- innovation and systems division: better margins are expected, tax rebates (CIR) for R&D expenses is a key point for this division (but will this tax rebate be maintained ?)

- "fair value" (DCF, comparables) : around 125 € (before 30 € special dividend), so around 95€. This figure means little by itself, but I guess it offers some kind of "protection" against a lowball buyout.

Recent information

CNIM has released its HY 2015 figures yesterday.

Backlog is somewhat better compared to end 2014.

Sales are down compared to HY 2014 but operational margin is suprisingly good (8%).

CNIM offers no guidance, other than "orders will be in progress in 2015".

CNIM stock went up ~5% as a result.

Putting it all together

What kind of earnings can we expect.

CNIM is not selling coke bottles or candies, but is mainly a contract-based business so predicting future activity is fraught with uncertainty, and as we've seen the outlook is not so rosy.

Based on baklog orders and HY figures, I think it is reasonnable to expect around 720-730 m€ sales.

I'll use a relatively conservative hypothesis of 5% operational margin instead of the 8% operational margin of the 1st HY 2015 which I don't really understand (the full HY report is not yet available).

I get a "normalized" EBIT of around 37 m€, and a EV/EBIT~ 6 (EV taking into account net cash 46 m€ from the 2015 HY report and 27 m€ retirement liabilities, no correction for negative working capital*).

Not expensive, but not dirt cheap either.

I'll wait for a bigger margin of Safety (if it comes !) before adding to my existing position. Anyway I hate chasing stocks when they go up and prefer to buy on dips.

Disclosure: long CNIM

*One point that bothered me is that CNIM benefits from pre-payments from the client on its contracts and shows a significant negative working capital (for instance almost ~100 m€ negative working capital in 2012). I was unsure about how to account for this excess cash in the EV calculation . However this negative working capital is only 7 m€ in 2014, so I neglect it.

Investissement avec un biais "Value" et petites capitalisations. Value and small caps investing in France.

mercredi 2 septembre 2015

mardi 26 mai 2015

Gevelot (ALGEV)

Summary

- Gevelot (ALGEV) makes auto parts and pumps

- illiquid stock, trades 1 time/day (fixing)

- 97 m€ net cash on the balance sheet vs 131 m€ market cap (at 145 €/share). EV/2014 EBIT~5

- Management shows no sign of returning this excess cash to shareholders, a situation quite similar to GEA ; cash will be used for investment

- low valuation but the easy money has been made ?

1) The company

The company has 2 main activities :

- parts manufacturer for the automotive industry (Gevelot extrusion and Dold GmbH)

- pumps for industry, oil/gas, food processing (PCM pumps)

Manufacturing/extrusion

They have posted several videos on youtube about the production sites (plants in France and Germany). So it's industry, presses, cold forming, heat treatment, machining and lots of CAPEX.

Pumps (PCM)

Apparently their technological specialty is PCP pumps, used for instance in oil and gas. PCM was founded in the 1930's by the inventor of PCP pumps.

Carburators (Gurtner)

Division sold at a loss in 2014.

2) Why is it cheap ?

Gevelot owned a 45% stake in Kudu, a canadian pump supplier using this same PCP technology.

Gevelot bought the remaining 55 % from its main shareholder, and sold it right back in 2013 to Schlumberger. Kudu (45%) was valued at 10 m€ in 2012 Gevelot books and Kudu (100 %) was sold for 168 m€ to Schlumberger. Nate at oddball stocks made an article about it in 2014.

3) Where will the cash go ?

Not in the minority shareholders pocket for sure. No special dividend, no announcement for a major buyback program. There's not even an increase in the usual dividend. The company has a modest share buyback program running though.

The last annual report gives an indication about how the cash has/will be used :

- sale of Gurtner division (at a loss), which seems a good move to me (loss making division, not a great outlook on carburators...)

- investment (CAPEX) in Extrusion (13 m€), I'm not sure the return on this invested capital will be great given the historic profitability of this branch (see below)

- acquisition of AMIK Oilfield Equipement and Rentals (Canada). I'm not sure it's the best timing given the evolution in oil/gas prices but I'm not an expert and I don't know if the price paid is right.

The capital is entirely controlled by the family.

A notable shareholder is the fund "Stock picking France", with a deep-value style.

Another fund present at the capital is William Higgon's Independance et Expansion fund, that I've mentioned in some previous article.

However these funds have bought a long time ago and at a much lower price (years ago for the 1st one).

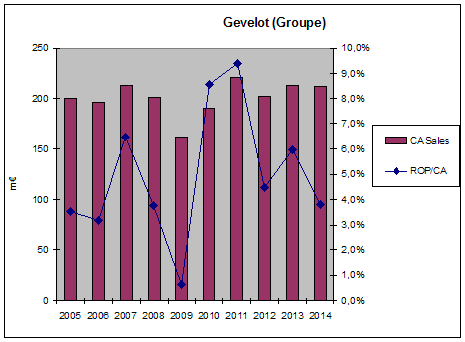

4) Financials

CA (Chiffre d'Affaires) = Sales

ROP/CA = EBIT margin

Breakdown between Extrusion and Pumps sectors

ROC = current operational result. MOP = current operational margin. Invest= investment

All figures (sales, results) are excluding intra-company transactions (more on that below).

The extrusion division is certainly not a "great" business: no competitive advantage, cyclical, heavy CAPEX, about 4-5% average (median value in the above table to be precise) operational margins. The outlook for the car industry seems recently better than the very difficult post 2008 years though.

The pump division has better margins (~10 %), less CAPEX requirements, but I've been unable to find the contribution of the oil/gas sector. Given the recent slump in oil prices, I wonder how to normalize earnings to account for the oil investment cycle.

5) Valuation

I've tried a sum of parts valuation, but one point that beats me is intra-company transactions (see table below). Just adding the estimated value of the extrusion and pumps branches without taking into accoung this internal transactions (-3 m€ in 2014) would lead to an overvaluation.

To get some idea, here's a very simplified DCF calculation, with conservative assumptions (no growth, average 4% margin, 12% cost of capital).

6) Conclusion

So yes Gevelot is cheap, but operates in a difficult business with no competitive advantage.

The lack of liquidity, and indifference to minority shareholders probably explains some part of the discount.

In any case it will take patience to see if the excess cash is used wisely and will produce results. Given the recent historical performance I doubt the return on this capital will equal its cost for a company like Gevelot.

Link to a very recent relevant article (Investing in bad businesses Damodaran).

Disclosure : long ALGEV

- Gevelot (ALGEV) makes auto parts and pumps

- illiquid stock, trades 1 time/day (fixing)

- 97 m€ net cash on the balance sheet vs 131 m€ market cap (at 145 €/share). EV/2014 EBIT~5

- Management shows no sign of returning this excess cash to shareholders, a situation quite similar to GEA ; cash will be used for investment

- low valuation but the easy money has been made ?

1) The company

The company has 2 main activities :

- parts manufacturer for the automotive industry (Gevelot extrusion and Dold GmbH)

- pumps for industry, oil/gas, food processing (PCM pumps)

Manufacturing/extrusion

They have posted several videos on youtube about the production sites (plants in France and Germany). So it's industry, presses, cold forming, heat treatment, machining and lots of CAPEX.

Pumps (PCM)

Apparently their technological specialty is PCP pumps, used for instance in oil and gas. PCM was founded in the 1930's by the inventor of PCP pumps.

Carburators (Gurtner)

Division sold at a loss in 2014.

2) Why is it cheap ?

Gevelot owned a 45% stake in Kudu, a canadian pump supplier using this same PCP technology.

Gevelot bought the remaining 55 % from its main shareholder, and sold it right back in 2013 to Schlumberger. Kudu (45%) was valued at 10 m€ in 2012 Gevelot books and Kudu (100 %) was sold for 168 m€ to Schlumberger. Nate at oddball stocks made an article about it in 2014.

3) Where will the cash go ?

Not in the minority shareholders pocket for sure. No special dividend, no announcement for a major buyback program. There's not even an increase in the usual dividend. The company has a modest share buyback program running though.

The last annual report gives an indication about how the cash has/will be used :

- sale of Gurtner division (at a loss), which seems a good move to me (loss making division, not a great outlook on carburators...)

- investment (CAPEX) in Extrusion (13 m€), I'm not sure the return on this invested capital will be great given the historic profitability of this branch (see below)

- acquisition of AMIK Oilfield Equipement and Rentals (Canada). I'm not sure it's the best timing given the evolution in oil/gas prices but I'm not an expert and I don't know if the price paid is right.

The capital is entirely controlled by the family.

A notable shareholder is the fund "Stock picking France", with a deep-value style.

Another fund present at the capital is William Higgon's Independance et Expansion fund, that I've mentioned in some previous article.

However these funds have bought a long time ago and at a much lower price (years ago for the 1st one).

4) Financials

CA (Chiffre d'Affaires) = Sales

ROP/CA = EBIT margin

Breakdown between Extrusion and Pumps sectors

ROC = current operational result. MOP = current operational margin. Invest= investment

All figures (sales, results) are excluding intra-company transactions (more on that below).

The extrusion division is certainly not a "great" business: no competitive advantage, cyclical, heavy CAPEX, about 4-5% average (median value in the above table to be precise) operational margins. The outlook for the car industry seems recently better than the very difficult post 2008 years though.

The pump division has better margins (~10 %), less CAPEX requirements, but I've been unable to find the contribution of the oil/gas sector. Given the recent slump in oil prices, I wonder how to normalize earnings to account for the oil investment cycle.

5) Valuation

I've tried a sum of parts valuation, but one point that beats me is intra-company transactions (see table below). Just adding the estimated value of the extrusion and pumps branches without taking into accoung this internal transactions (-3 m€ in 2014) would lead to an overvaluation.

To get some idea, here's a very simplified DCF calculation, with conservative assumptions (no growth, average 4% margin, 12% cost of capital).

6) Conclusion

So yes Gevelot is cheap, but operates in a difficult business with no competitive advantage.

The lack of liquidity, and indifference to minority shareholders probably explains some part of the discount.

In any case it will take patience to see if the excess cash is used wisely and will produce results. Given the recent historical performance I doubt the return on this capital will equal its cost for a company like Gevelot.

Link to a very recent relevant article (Investing in bad businesses Damodaran).

Disclosure : long ALGEV

mardi 27 janvier 2015

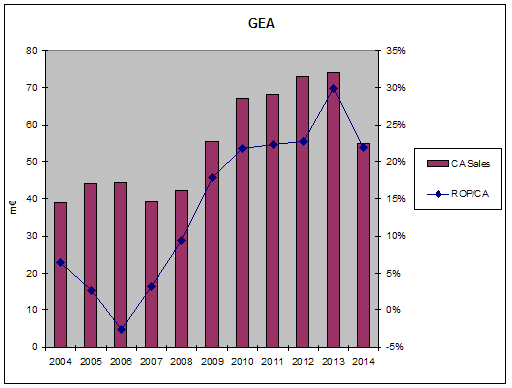

GEA 2014 results (short article)

GEA presented today its 2014 annual results.

Sorry for the telegraphic style.

See Fininfohub article here (analyst presentation in English, with lots of interesting information from management).

Compared to my HY2014 worst-case scenario (9 to 10 m€ op result), the 2014 results (EBIT = 12 m€, net result 8 m€) are better than I expected.

GEA apparently cut its costs (outside purchases, interim jobs) quickly, without reducing its permanent workforce.

Backlog seems stabilized, good news.

Dividend cut (constant 33% distribution ratio), rather stingy given the huge cash position.

Tecsidel deal is not finalized. No info on the purchase price.

Net cash is down 57 m€ 2014 vs 60 m€ end 2013, compared to 8 m€ net profit. Why is net cash down ? Some increase of working capital requirement ? Strange because I would expect working capital to decrease when sales are down. Or maybe some investment that's not mentioned in the news release.

Stock closed down 8% today @ 77 €, which surprises me.

Let's assume that GEA pays 1x sales for Tecsidel (about 14 m€ ?)

EV = 92 (market cap) - 57 (cash) +14 (tecsidel ?) = 49 m€

EV/2014 EBIT = 4

Anyway today's drop leaves me rather cold, because I halved my position this summer/fall after :

- Amiral Gestion announced (this summer I think) that they had sold their position at a loss because they had underestimated the decrease in the toll equipment market in France

- Kapsch relased earlier a rather bleak outlook "no invitations to tender...are in the near vicinity" "strategic adjustments to changed market conditions"

- liquidity was super low

- I was getting scared and unable to remain rational because the position was too big in my portfolio.

I'm prepared to start buying again if price drops to silly levels.

Sorry for the telegraphic style.

See Fininfohub article here (analyst presentation in English, with lots of interesting information from management).

Compared to my HY2014 worst-case scenario (9 to 10 m€ op result), the 2014 results (EBIT = 12 m€, net result 8 m€) are better than I expected.

GEA apparently cut its costs (outside purchases, interim jobs) quickly, without reducing its permanent workforce.

Backlog seems stabilized, good news.

Dividend cut (constant 33% distribution ratio), rather stingy given the huge cash position.

Tecsidel deal is not finalized. No info on the purchase price.

Net cash is down 57 m€ 2014 vs 60 m€ end 2013, compared to 8 m€ net profit. Why is net cash down ? Some increase of working capital requirement ? Strange because I would expect working capital to decrease when sales are down. Or maybe some investment that's not mentioned in the news release.

Stock closed down 8% today @ 77 €, which surprises me.

Let's assume that GEA pays 1x sales for Tecsidel (about 14 m€ ?)

EV = 92 (market cap) - 57 (cash) +14 (tecsidel ?) = 49 m€

EV/2014 EBIT = 4

Anyway today's drop leaves me rather cold, because I halved my position this summer/fall after :

- Amiral Gestion announced (this summer I think) that they had sold their position at a loss because they had underestimated the decrease in the toll equipment market in France

- Kapsch relased earlier a rather bleak outlook "no invitations to tender...are in the near vicinity" "strategic adjustments to changed market conditions"

- liquidity was super low

- I was getting scared and unable to remain rational because the position was too big in my portfolio.

I'm prepared to start buying again if price drops to silly levels.

lundi 12 janvier 2015

2014 review

Given how this new year has started in France, I guess it can only get better. Best wishes to everybody anyway.

I will refrain from making comments on the recent events, as this is an investing blog.

My portfolio is up 11% in 2014 vs 35 % in 2013.

I have no real benchmark, but I invest primarily in French small caps, so it makes sense to compare with the following benchmarks :

- the mid&small caps index (MS190) is up 8.4%

- investment funds with the same universe (value, small caps)

- Amiral Gestion Sextant PEA up ~12-13 %

- HMG Decouvertes up ~12 %

- Moneta micro entreprises up ~8 %

- Independance et expansion up ~16%

So my performance is more or less in line, but certainly not spectacular.

I do track my operations/porfolio on Excel but one issue I have is that I'm not able to quantify which positions/decisions have contributed the most to a given year performance (if I understand correctly this is called performance attribution).

I think the most positive contributions went from my biggest existing lines (Precia and Installux), but certainly not from the stocks I talked about in 2014, namely GEA and SII. I'll do an update on those later.

The place to be in 2014 for French small caps was biotech (Cellectis +430 %, Genfit +322 %, Adocia +709 %, Innate Pharma +60 %, DBV Technologies +305%...), way outside my (admittedly narrow) circle of competence anyway.

On the other side, some companies in the oil service sector (Technip, CGG, Vallourec,...) have been trashed. I have the feeling that all this is a little silly and temporary, but will not venture further.

I've spent most of the year with a quite important cash position ~20%, because of insufficient opportunities. A short window opened mid oct when the market went down but I still have a large cash position.

The creation of the PEA-PME seems to be rather unsuccessful, which is fine for me (less money inflow, so less competition).

I'm heavily invested in French stocks for good reasons (tax deferred account, less broker fees, probably much less domestic/foreign competition than, say, the US market, less efficient market) and bad (domestic bias, lack of time,...) reasons.

One of my new year resolutions is to diversify more, which means investing in an area relatively decoupled from the Eurozone.

I will refrain from making comments on the recent events, as this is an investing blog.

My portfolio is up 11% in 2014 vs 35 % in 2013.

I have no real benchmark, but I invest primarily in French small caps, so it makes sense to compare with the following benchmarks :

- the mid&small caps index (MS190) is up 8.4%

- investment funds with the same universe (value, small caps)

- Amiral Gestion Sextant PEA up ~12-13 %

- HMG Decouvertes up ~12 %

- Moneta micro entreprises up ~8 %

- Independance et expansion up ~16%

So my performance is more or less in line, but certainly not spectacular.

I do track my operations/porfolio on Excel but one issue I have is that I'm not able to quantify which positions/decisions have contributed the most to a given year performance (if I understand correctly this is called performance attribution).

I think the most positive contributions went from my biggest existing lines (Precia and Installux), but certainly not from the stocks I talked about in 2014, namely GEA and SII. I'll do an update on those later.

The place to be in 2014 for French small caps was biotech (Cellectis +430 %, Genfit +322 %, Adocia +709 %, Innate Pharma +60 %, DBV Technologies +305%...), way outside my (admittedly narrow) circle of competence anyway.

On the other side, some companies in the oil service sector (Technip, CGG, Vallourec,...) have been trashed. I have the feeling that all this is a little silly and temporary, but will not venture further.

I've spent most of the year with a quite important cash position ~20%, because of insufficient opportunities. A short window opened mid oct when the market went down but I still have a large cash position.

The creation of the PEA-PME seems to be rather unsuccessful, which is fine for me (less money inflow, so less competition).

I'm heavily invested in French stocks for good reasons (tax deferred account, less broker fees, probably much less domestic/foreign competition than, say, the US market, less efficient market) and bad (domestic bias, lack of time,...) reasons.

One of my new year resolutions is to diversify more, which means investing in an area relatively decoupled from the Eurozone.

Inscription à :

Articles (Atom)