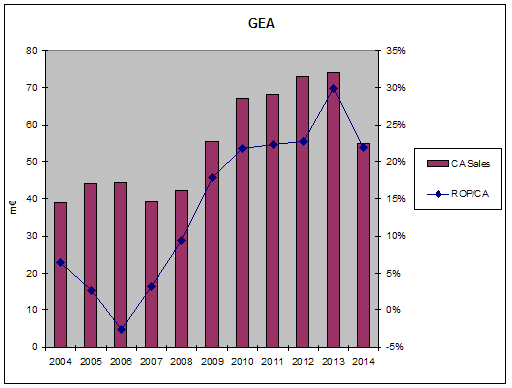

GEA presented today its 2014 annual results.

Sorry for the telegraphic style.

See Fininfohub article here (analyst presentation in English, with lots of interesting information from management).

Compared to my HY2014 worst-case scenario (9 to 10 m€ op result), the 2014 results (EBIT = 12 m€, net result 8 m€) are better than I expected.

GEA apparently cut its costs (outside purchases, interim jobs) quickly, without reducing its permanent workforce.

Backlog seems stabilized, good news.

Dividend cut (constant 33% distribution ratio), rather stingy given the huge cash position.

Tecsidel deal is not finalized. No info on the purchase price.

Net cash is down 57 m€ 2014 vs 60 m€ end 2013, compared to 8 m€ net profit. Why is net cash down ? Some increase of working capital requirement ? Strange because I would expect working capital to decrease when sales are down. Or maybe some investment that's not mentioned in the news release.

Stock closed down 8% today @ 77 €, which surprises me.

Let's assume that GEA pays 1x sales for Tecsidel (about 14 m€ ?)

EV = 92 (market cap) - 57 (cash) +14 (tecsidel ?) = 49 m€

EV/2014 EBIT = 4

Anyway today's drop leaves me rather cold, because I halved my position this summer/fall after :

- Amiral Gestion announced (this summer I think) that they had sold their position at a loss because they had underestimated the decrease in the toll equipment market in France

- Kapsch relased earlier a rather bleak outlook "no invitations to tender...are in the near vicinity" "strategic adjustments to changed market conditions"

- liquidity was super low

- I was getting scared and unable to remain rational because the position was too big in my portfolio.

I'm prepared to start buying again if price drops to silly levels.

Investissement avec un biais "Value" et petites capitalisations. Value and small caps investing in France.

mardi 27 janvier 2015

lundi 12 janvier 2015

2014 review

Given how this new year has started in France, I guess it can only get better. Best wishes to everybody anyway.

I will refrain from making comments on the recent events, as this is an investing blog.

My portfolio is up 11% in 2014 vs 35 % in 2013.

I have no real benchmark, but I invest primarily in French small caps, so it makes sense to compare with the following benchmarks :

- the mid&small caps index (MS190) is up 8.4%

- investment funds with the same universe (value, small caps)

- Amiral Gestion Sextant PEA up ~12-13 %

- HMG Decouvertes up ~12 %

- Moneta micro entreprises up ~8 %

- Independance et expansion up ~16%

So my performance is more or less in line, but certainly not spectacular.

I do track my operations/porfolio on Excel but one issue I have is that I'm not able to quantify which positions/decisions have contributed the most to a given year performance (if I understand correctly this is called performance attribution).

I think the most positive contributions went from my biggest existing lines (Precia and Installux), but certainly not from the stocks I talked about in 2014, namely GEA and SII. I'll do an update on those later.

The place to be in 2014 for French small caps was biotech (Cellectis +430 %, Genfit +322 %, Adocia +709 %, Innate Pharma +60 %, DBV Technologies +305%...), way outside my (admittedly narrow) circle of competence anyway.

On the other side, some companies in the oil service sector (Technip, CGG, Vallourec,...) have been trashed. I have the feeling that all this is a little silly and temporary, but will not venture further.

I've spent most of the year with a quite important cash position ~20%, because of insufficient opportunities. A short window opened mid oct when the market went down but I still have a large cash position.

The creation of the PEA-PME seems to be rather unsuccessful, which is fine for me (less money inflow, so less competition).

I'm heavily invested in French stocks for good reasons (tax deferred account, less broker fees, probably much less domestic/foreign competition than, say, the US market, less efficient market) and bad (domestic bias, lack of time,...) reasons.

One of my new year resolutions is to diversify more, which means investing in an area relatively decoupled from the Eurozone.

I will refrain from making comments on the recent events, as this is an investing blog.

My portfolio is up 11% in 2014 vs 35 % in 2013.

I have no real benchmark, but I invest primarily in French small caps, so it makes sense to compare with the following benchmarks :

- the mid&small caps index (MS190) is up 8.4%

- investment funds with the same universe (value, small caps)

- Amiral Gestion Sextant PEA up ~12-13 %

- HMG Decouvertes up ~12 %

- Moneta micro entreprises up ~8 %

- Independance et expansion up ~16%

So my performance is more or less in line, but certainly not spectacular.

I do track my operations/porfolio on Excel but one issue I have is that I'm not able to quantify which positions/decisions have contributed the most to a given year performance (if I understand correctly this is called performance attribution).

I think the most positive contributions went from my biggest existing lines (Precia and Installux), but certainly not from the stocks I talked about in 2014, namely GEA and SII. I'll do an update on those later.

The place to be in 2014 for French small caps was biotech (Cellectis +430 %, Genfit +322 %, Adocia +709 %, Innate Pharma +60 %, DBV Technologies +305%...), way outside my (admittedly narrow) circle of competence anyway.

On the other side, some companies in the oil service sector (Technip, CGG, Vallourec,...) have been trashed. I have the feeling that all this is a little silly and temporary, but will not venture further.

I've spent most of the year with a quite important cash position ~20%, because of insufficient opportunities. A short window opened mid oct when the market went down but I still have a large cash position.

The creation of the PEA-PME seems to be rather unsuccessful, which is fine for me (less money inflow, so less competition).

I'm heavily invested in French stocks for good reasons (tax deferred account, less broker fees, probably much less domestic/foreign competition than, say, the US market, less efficient market) and bad (domestic bias, lack of time,...) reasons.

One of my new year resolutions is to diversify more, which means investing in an area relatively decoupled from the Eurozone.

Inscription à :

Articles (Atom)