Vivendi (VIV)

Pour la version Française, voir ici.

I have hesitated a long time before putting this post online. Its unusual length reflects my doubts and my lack of conviction.

Also see the 2012 update here

Introduction

Vivendi seems rather cheap (yield, PER, Cash flow ,...). For a last quote of ~€ 16 it currently offers a 8.8% yield which is very attractive and quite unusual.

But:

- It's a big cap. Being an unsophisticated small investor it is unlikely that I find value after a dozen of professional analysts currently following the stock. That being said it is known that analysts exhibit sometimes herd behavior

- Did I miss something ? Why such a high yield ?

- The accounts are difficult to read for me, given the size and complexity of the company and the multiple acquisitions / sales of subsidiaries and participations during the recent years. Recent changes in taxation complicate things

- Overall I have had nothing but bad surprises (read : losses) with Vivendi and that probably influences my opinion, however I'll try to be as objective as possible

- I do not do technical analysis, but the 5 year graph is frightening. Don't try to catch a falling knife as they say.

I have hesitated a long time before putting this post online. Its unusual length reflects my doubts and my lack of conviction.

Also see the 2012 update here

Introduction

Vivendi seems rather cheap (yield, PER, Cash flow ,...). For a last quote of ~€ 16 it currently offers a 8.8% yield which is very attractive and quite unusual.

But:

- It's a big cap. Being an unsophisticated small investor it is unlikely that I find value after a dozen of professional analysts currently following the stock. That being said it is known that analysts exhibit sometimes herd behavior

- Did I miss something ? Why such a high yield ?

- The accounts are difficult to read for me, given the size and complexity of the company and the multiple acquisitions / sales of subsidiaries and participations during the recent years. Recent changes in taxation complicate things

- Overall I have had nothing but bad surprises (read : losses) with Vivendi and that probably influences my opinion, however I'll try to be as objective as possible

- I do not do technical analysis, but the 5 year graph is frightening. Don't try to catch a falling knife as they say.

You've been warned.

Vivendi is one of the 1st group of global telecommunications and media.

Price

Price / Quote: 16 €

Number of shares (diluted) : 1,239,900,000

VIV has announced the acquisition by its subsidiary Canal + of Direct 8, paid in large part by the emission of new Vivendi shares (see excerpt from the press release below). So I add 16.2 million shares, representing 1,256,100,000 shares in total.

Capitalization: € 20.1 billion / € 20.1 bn

I like to use the Entreprise Value to include debt :

- EV/ROP 2010 = 8

- EV/mean operating result (2004 to 2010 average) = 8

- EV/mean FCF (2004 à 2010 average) = 10

Note that I included the debt from the SFR deal in the EV but that past results do not include it. I's a conservative assumption.

What others say

It is also the opinion of the following investors:

- Heard on the French radio BFM last Friday, Charles de Vaulx , manager of IVA funds,

- this blogger ( The lonely Value investor ) here and here, who is apparently a US fund manager: Schacht Value Investors . Some light (tongue in cheek ?) French bashing in his posts, it's rather entertaining.

However Exane BNP Paribas disagrees (found via google)

"(Tradingsat.com) - Exane has released a note to" Underperform ", against" Neutral "before, by reducing 17% its price target to 17.5 euros. The broker points out the risks associated with increased competition, which could weigh on the three pillars of the group (Activision Blizzard, UMG, SFR).

"Vivendi is trading at valuation levels comparable to those of its peers, despite greater exposure to the French market of telecomunications, higher risk on the profitability and limited ability to increase the dividend to meet expectations," said Exane in a sector study.

Without access to their note, it's hard to comment, but I will talk of Illiad (Illiad = Free ) below.

In December 2009 the opinion of Exane was much more positive:

(Tradingsat.com) - Exane BNP Paribas on Monday reiterated his opinion "Outperform" and his price target to 24 euros for Vivendi.

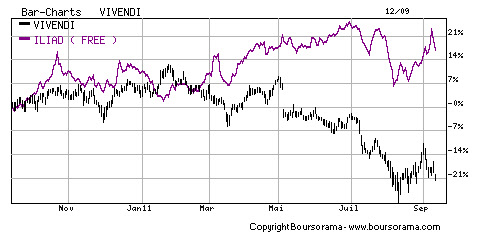

Vivendi vs Free

Free is one of Vivendi competitors on the ADSL market. Free parent company is Illiad (Ticker: ILD).

The graph below shows the evolution of Vivendi compared to Free/Iliad.

The graph speaks for itself.

We can also compare some valuation ratios between Vivendi and Illiad (I have not analyzed Illiad in detail).

The comparison is quite telling.

To be honest, it is normal for Iliad to have a low FCF since the company is growing fast.

The market has very favorable expectations for Illiad, based on its strong past growth, creativity (IMHO it is clear that Free has always been technically and commercially a step ahead of France Telecom and Vivendi) and very unfavorable expectations for Vivendi.

You decide.

Personally I find Illiad valuation far too high.

Free announced his arrival on the mobile phone market, and rumors on the net (search google) announce very aggressive commercial offers, almost 50% below current prices. Vivendi will react (the same thing happened for the ADSL providing businness).

But it is clear that the profit margins of Vivendi (SFR) will suffer.

Insider trading

See below the transactions listed on the site of the AMF (=French SEC) website since 2008 (manual copy , so I may have made a few mistakes).

Don't know what to make of this, except admire Levy's (current CEO) timing on his sale (stock-options). The others are losing money (makes me feel less alone).

Personal experience with Vivendi

I've been a Vivendi client for a few years :

- for my cell phone (SFR)

- for my home ADSL line.

Some comments:

- Hotline: obviously delocalized in a foreign french-speaking country (Maghreb?). Difficult to understand them at times, and lack of fluidity in the discussion but to be fair it's unusual

- 2 ADSL problems in a few years, quickly resolved. A technician came within 24h, so I was pleasantly surprised

- My mobile/cell phone package is no longer competitive compared to current offers. In response, they propose a deal with more call time (which does not interest me) but at the same price. I am looking for a cheapest offer, and I'll probably leave them for La Poste Mobile, a virtual operator that uses ...SFR network. Go figure.

Latest News

Acquisition of the remaining SFR stake

Vivendi bought Vodafone's 44% stake in SFR for 7950 m €. Some analysts (UBS) said that they overpaid:

"It seems that Vivendi has overpaid for SFR," the broker, referring to Vivendi's acquisition of 44% stake to Vodafone in the telecommunications operator.

The amount paid by Vivendi values SFR 6.5 times 2011 EBITDA, a ratio higher than 4.5 times EBITDA estimated fair by UBS, who notes in passing that Vivendi has doubled its exposure to the mobile business just before competition gets stronger. "

Change in taxation

Looking for cash, the French government has cancelled a taxation measure called the "Consolidated Global profit Tax system" abbreviated BMC in French.

Here's what Vivendi 2010 annual report says on it (page 201).

Under the Consolidated Global Profit Tax System, Vivendi is entitled to consolidate its own tax profits and losses with the tax profits and losses of subsidiaries that are at least 50% directly or indirectly owned by it, and that are located in France or abroad. Subsidiaries in which Vivendi directly or indirectly owns at least 50% of the outstanding shares, either French or abroad, as well as Canal+ SA, fall within the scope of the Consolidated Global Profit Tax System (Activision Blizzard,Universal Music Group, SFR, Maroc Telecom, GVT and Canal+ Group). Under Vivendi’s authorization to use the Consolidated Global Profit Tax System, Vivendi is entitled to use ordinary losses carried forward.

As of December 31, 2009, Vivendi carried forward losses of €6,168 million as the head company consolidating for tax purposes the results of its French and foreign subsidiaries.

From Les Echos "According to some analysts, the cumulative impact of the BMC tax system cancellation may vary between 260 and 400 million euros in 2012."

Canal + et Direct 8

Bolloré and CANAL+ Groups have announced a strategic partnership involving Bolloré’s free channels. The proposed agreement provides for CANAL+ Group to acquire a stake of 60 % in the Bolloré Group’s television business, which includes the Direct 8 and Direct Star channels. This investment would be paid for with Vivendi shares. The total value (100%) of the assets is estimated at a maximum of €465M.

According to the AGEFI journal , Bolloré has made a good deal. I did not went further (except take into account the number of shares that will be created, which is rather conservative: immediate dilution without taking into account the future benefits of Direct 8). Note that Bolloré has accepted a payment in shares valued at € 17 , which means I guess he does not find that price overvalued.

Conclusion

As always, there are positives and negatives.

The stock is not expensive, as all the telecom sector in Europe apparently. Cheap but not dirt-cheap.

The yield is very high and the dividend is amply covered by the cash flow. You get paid to wait for Vivendi revaluation by Mr Maket (if there is a revaluation).

But competition is strong and growing.

I found the following comment from one of the analysts following VIV that summarizes nicely the situation.

“Vivendi’s assets are of reasonable quality but there is no growth,” said O’Shea. “There’s no real rush to buy Vivendi if you’re an investor because there is nothing really exciting happening and some downward momentum for the next couple of years.”

This comment dates from 04/08/11. The stock has lost 20% since.

I hope that the "downward momentum" will calm down a bit!

On the other hand, the activities of Vivendi should be rather stable during a recession (I don't imagine people cancelling their mobile and internet subscriptions to cut their budget, but I may be wrong).

I am a cautious (should have been more cautious before) buyer at € 16. Note that the 2011 low (for now) (and 3, 5 and even 8 years low) was reached a few weeks ago to € 14.1.

Feedback (positive and negative) appreciated.

Net sales by business segment are as follows:

- Telecomunications (56.8%) mobile operations performed through SFR (76.7% of sales; second French operator), fixed line, mobile and Internet access provided by Maroc Telecom (17%; Moroccan No. 1), fixed telephony and Internet access provided by GVT (6.3% Brazilian No. 1);

- Media (43.2%) holding and operating TV channels (37.7% of sales, Canal + Group, No. 1 of French pay-TV), music publishing and distribution (35.6% world No. 1, Universal Music Group) and development of interactive games (26.7%; World No. 1, Activision Blizzard).

The geographical distribution of sales is as follows: France (59.2%), Europe (10.6%), United States (11.7%), Morocco (7.9%), Brazil (3.8%) and other (6.8%).

- Telecomunications (56.8%) mobile operations performed through SFR (76.7% of sales; second French operator), fixed line, mobile and Internet access provided by Maroc Telecom (17%; Moroccan No. 1), fixed telephony and Internet access provided by GVT (6.3% Brazilian No. 1);

- Media (43.2%) holding and operating TV channels (37.7% of sales, Canal + Group, No. 1 of French pay-TV), music publishing and distribution (35.6% world No. 1, Universal Music Group) and development of interactive games (26.7%; World No. 1, Activision Blizzard).

The geographical distribution of sales is as follows: France (59.2%), Europe (10.6%), United States (11.7%), Morocco (7.9%), Brazil (3.8%) and other (6.8%).

Employees: 51,272

I refer you to this article summarizing the adventures (and misadventures) of Vivendi during and after the Internet bubble. The main result : massive losses, which has implications for current taxes (see below).

Let's throw a veil over this and turn to the present.

Let's throw a veil over this and turn to the present.

Price

Price / Quote: 16 €

Number of shares (diluted) : 1,239,900,000

VIV has announced the acquisition by its subsidiary Canal + of Direct 8, paid in large part by the emission of new Vivendi shares (see excerpt from the press release below). So I add 16.2 million shares, representing 1,256,100,000 shares in total.

"The proposed agreement between Bolloré Group and Canal+

Group provides for Canal+ Group to immediately acquire a stake of 60% in

Bolloré Group’s television business, which includes the channels Direct

8 and Direct Star.

• Valuation of Bolloré Group’s television assets and terms of payment:

- At the closing of the transaction (60% of the equity):

issue of 16.2 million Vivendi shares with a valuation based on the last

four months average (€17.3), or €279 million.

- Upon any exercise, in three years, of the put and call

options relating to the remaining 40% of the equity: a cash payment

will be made of €186 million"

Capitalization: € 20.1 billion / € 20.1 bn

Balance sheet ( 1HY 2011 )

I did not bother to look at the balance sheet in detail.

The sum of the current financial debt (€ 4.5 billion) and long term debt (12.9 € billion) less cash (€ 2.9 billion) is € 14.5 billion, close to shareholders equity (€ 18.6 billion). VIVENDI's debt is quite large.

I did not bother to look at the balance sheet in detail.

The sum of the current financial debt (€ 4.5 billion) and long term debt (12.9 € billion) less cash (€ 2.9 billion) is € 14.5 billion, close to shareholders equity (€ 18.6 billion). VIVENDI's debt is quite large.

Goodwill (24.9 € billion) far exceeds the equity.

So no margin of safety to fall back on (tangible assets or excess cash). This does not mean it does not exist. But I can not evaluate it easily. You can refer to the Lonely investor article for a sum-of-parts valuation.

A note : between end 2010 and June 2011 book value fell from € 24.0 billion to 18.6 billion €, an accounting effect due to the SFR deal with Vodaphone. But rather surprising for a simple guy like me.

Entreprise Value

EV = Market cap + LT debt + current debt - cash = 34.6 billion €

Income statement and cash flow

The table below provides some financial data taken from the annual reports.

As usual, sorry for the possible copy/paste errors.

For a given fiscal year, Vivendi sometimes updates its financial accounts the next year (corrections, changes in accounting standards,...). I don't generally update my figures, so there might be discrepancies.

ROP = Operating income

Vivendi also publishes an "adjusted" operating income expected to better reflect the Group's performance, by taking into account unusual operations.

On average, adjusted operating income is higher than the published "regular" operational result so to be prudent I did not use it.

I haven't "normalized" earnings to take into account unusual operations.

OCF = Cash flow from operations

FCF = Cash flow from operations - CAPEX

There is also a column giving the long-term debt

and a column calculating the FCF - dividend paid to shareholders, to verify that the dividend is sustainable (see for example my article on Total ).

So no margin of safety to fall back on (tangible assets or excess cash). This does not mean it does not exist. But I can not evaluate it easily. You can refer to the Lonely investor article for a sum-of-parts valuation.

A note : between end 2010 and June 2011 book value fell from € 24.0 billion to 18.6 billion €, an accounting effect due to the SFR deal with Vodaphone. But rather surprising for a simple guy like me.

Entreprise Value

EV = Market cap + LT debt + current debt - cash = 34.6 billion €

Income statement and cash flow

The table below provides some financial data taken from the annual reports.

As usual, sorry for the possible copy/paste errors.

For a given fiscal year, Vivendi sometimes updates its financial accounts the next year (corrections, changes in accounting standards,...). I don't generally update my figures, so there might be discrepancies.

ROP = Operating income

Vivendi also publishes an "adjusted" operating income expected to better reflect the Group's performance, by taking into account unusual operations.

On average, adjusted operating income is higher than the published "regular" operational result so to be prudent I did not use it.

I haven't "normalized" earnings to take into account unusual operations.

OCF = Cash flow from operations

FCF = Cash flow from operations - CAPEX

There is also a column giving the long-term debt

and a column calculating the FCF - dividend paid to shareholders, to verify that the dividend is sustainable (see for example my article on Total ).

I have averaged earnings over the last 7 years.

Some valuation ratios :

- P/E 2010 = 9

- P/E 2004 to 2010 average = 7

- Free cash flow yield for 2010 = 18 %

- yield (2010 dividend) = 8.8 %, with a dividend increase announced for next year!

- Free cash flow yield for 2010 = 18 %

- yield (2010 dividend) = 8.8 %, with a dividend increase announced for next year!

I like to use the Entreprise Value to include debt :

- EV/ROP 2010 = 8

- EV/mean operating result (2004 to 2010 average) = 8

- EV/mean FCF (2004 à 2010 average) = 10

Note that I included the debt from the SFR deal in the EV but that past results do not include it. I's a conservative assumption.

EV/mean FCF is one of my favorite ratios. I set my criteria to about 10. It's unusual to see a big cap at this level.

All these ratios say that VIV is cheap. Cheap but not dirt-cheap yet.

What others say

It is also the opinion of the following investors:

- Heard on the French radio BFM last Friday, Charles de Vaulx , manager of IVA funds,

- this blogger ( The lonely Value investor ) here and here, who is apparently a US fund manager: Schacht Value Investors . Some light (tongue in cheek ?) French bashing in his posts, it's rather entertaining.

However Exane BNP Paribas disagrees (found via google)

"(Tradingsat.com) - Exane has released a note to" Underperform ", against" Neutral "before, by reducing 17% its price target to 17.5 euros. The broker points out the risks associated with increased competition, which could weigh on the three pillars of the group (Activision Blizzard, UMG, SFR).

"Vivendi is trading at valuation levels comparable to those of its peers, despite greater exposure to the French market of telecomunications, higher risk on the profitability and limited ability to increase the dividend to meet expectations," said Exane in a sector study.

Without access to their note, it's hard to comment, but I will talk of Illiad (Illiad = Free ) below.

In December 2009 the opinion of Exane was much more positive:

(Tradingsat.com) - Exane BNP Paribas on Monday reiterated his opinion "Outperform" and his price target to 24 euros for Vivendi.

Vivendi vs Free

Free is one of Vivendi competitors on the ADSL market. Free parent company is Illiad (Ticker: ILD).

The graph below shows the evolution of Vivendi compared to Free/Iliad.

The graph speaks for itself.

We can also compare some valuation ratios between Vivendi and Illiad (I have not analyzed Illiad in detail).

The comparison is quite telling.

To be honest, it is normal for Iliad to have a low FCF since the company is growing fast.

The market has very favorable expectations for Illiad, based on its strong past growth, creativity (IMHO it is clear that Free has always been technically and commercially a step ahead of France Telecom and Vivendi) and very unfavorable expectations for Vivendi.

You decide.

Personally I find Illiad valuation far too high.

Free announced his arrival on the mobile phone market, and rumors on the net (search google) announce very aggressive commercial offers, almost 50% below current prices. Vivendi will react (the same thing happened for the ADSL providing businness).

But it is clear that the profit margins of Vivendi (SFR) will suffer.

Insider trading

See below the transactions listed on the site of the AMF (=French SEC) website since 2008 (manual copy , so I may have made a few mistakes).

Don't know what to make of this, except admire Levy's (current CEO) timing on his sale (stock-options). The others are losing money (makes me feel less alone).

Personal experience with Vivendi

I've been a Vivendi client for a few years :

- for my cell phone (SFR)

- for my home ADSL line.

Some comments:

- Hotline: obviously delocalized in a foreign french-speaking country (Maghreb?). Difficult to understand them at times, and lack of fluidity in the discussion but to be fair it's unusual

- 2 ADSL problems in a few years, quickly resolved. A technician came within 24h, so I was pleasantly surprised

- My mobile/cell phone package is no longer competitive compared to current offers. In response, they propose a deal with more call time (which does not interest me) but at the same price. I am looking for a cheapest offer, and I'll probably leave them for La Poste Mobile, a virtual operator that uses ...SFR network. Go figure.

Latest News

Acquisition of the remaining SFR stake

Vivendi bought Vodafone's 44% stake in SFR for 7950 m €. Some analysts (UBS) said that they overpaid:

"It seems that Vivendi has overpaid for SFR," the broker, referring to Vivendi's acquisition of 44% stake to Vodafone in the telecommunications operator.

The amount paid by Vivendi values SFR 6.5 times 2011 EBITDA, a ratio higher than 4.5 times EBITDA estimated fair by UBS, who notes in passing that Vivendi has doubled its exposure to the mobile business just before competition gets stronger. "

Change in taxation

Looking for cash, the French government has cancelled a taxation measure called the "Consolidated Global profit Tax system" abbreviated BMC in French.

Here's what Vivendi 2010 annual report says on it (page 201).

Under the Consolidated Global Profit Tax System, Vivendi is entitled to consolidate its own tax profits and losses with the tax profits and losses of subsidiaries that are at least 50% directly or indirectly owned by it, and that are located in France or abroad. Subsidiaries in which Vivendi directly or indirectly owns at least 50% of the outstanding shares, either French or abroad, as well as Canal+ SA, fall within the scope of the Consolidated Global Profit Tax System (Activision Blizzard,Universal Music Group, SFR, Maroc Telecom, GVT and Canal+ Group). Under Vivendi’s authorization to use the Consolidated Global Profit Tax System, Vivendi is entitled to use ordinary losses carried forward.

As of December 31, 2009, Vivendi carried forward losses of €6,168 million as the head company consolidating for tax purposes the results of its French and foreign subsidiaries.

From Les Echos "According to some analysts, the cumulative impact of the BMC tax system cancellation may vary between 260 and 400 million euros in 2012."

Let's be pessimistic and retain 400 m€.

The mean FCF over the last 7 years is € 3335 billion. Minus 400 m€, the EV / FCF ratio goes up from 10 to 12. The impact is far from negligible.

However this FCF is more than enough to sustain the current dividend.

Canal + et Direct 8

Bolloré and CANAL+ Groups have announced a strategic partnership involving Bolloré’s free channels. The proposed agreement provides for CANAL+ Group to acquire a stake of 60 % in the Bolloré Group’s television business, which includes the Direct 8 and Direct Star channels. This investment would be paid for with Vivendi shares. The total value (100%) of the assets is estimated at a maximum of €465M.

According to the AGEFI journal , Bolloré has made a good deal. I did not went further (except take into account the number of shares that will be created, which is rather conservative: immediate dilution without taking into account the future benefits of Direct 8). Note that Bolloré has accepted a payment in shares valued at € 17 , which means I guess he does not find that price overvalued.

Conclusion

As always, there are positives and negatives.

The stock is not expensive, as all the telecom sector in Europe apparently. Cheap but not dirt-cheap.

The yield is very high and the dividend is amply covered by the cash flow. You get paid to wait for Vivendi revaluation by Mr Maket (if there is a revaluation).

But competition is strong and growing.

I found the following comment from one of the analysts following VIV that summarizes nicely the situation.

“Vivendi’s assets are of reasonable quality but there is no growth,” said O’Shea. “There’s no real rush to buy Vivendi if you’re an investor because there is nothing really exciting happening and some downward momentum for the next couple of years.”

This comment dates from 04/08/11. The stock has lost 20% since.

I hope that the "downward momentum" will calm down a bit!

On the other hand, the activities of Vivendi should be rather stable during a recession (I don't imagine people cancelling their mobile and internet subscriptions to cut their budget, but I may be wrong).

I am a cautious (should have been more cautious before) buyer at € 16. Note that the 2011 low (for now) (and 3, 5 and even 8 years low) was reached a few weeks ago to € 14.1.

Feedback (positive and negative) appreciated.

Aucun commentaire:

Enregistrer un commentaire