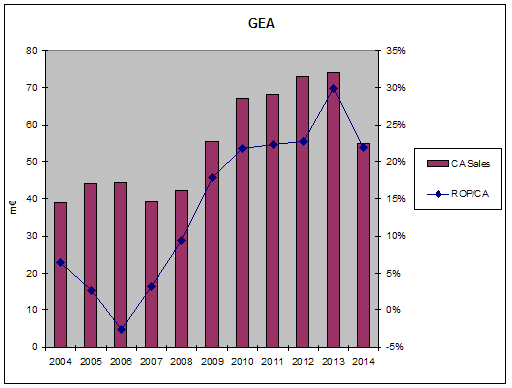

GEA presented today its 2014 annual results.

Sorry for the telegraphic style.

See Fininfohub article here (analyst presentation in English, with lots of interesting information from management).

Compared to my HY2014 worst-case scenario (9 to 10 m€ op result), the 2014 results (EBIT = 12 m€, net result 8 m€) are better than I expected.

GEA apparently cut its costs (outside purchases, interim jobs) quickly, without reducing its permanent workforce.

Backlog seems stabilized, good news.

Dividend cut (constant 33% distribution ratio), rather stingy given the huge cash position.

Tecsidel deal is not finalized. No info on the purchase price.

Net cash is down 57 m€ 2014 vs 60 m€ end 2013, compared to 8 m€ net profit. Why is net cash down ? Some increase of working capital requirement ? Strange because I would expect working capital to decrease when sales are down. Or maybe some investment that's not mentioned in the news release.

Stock closed down 8% today @ 77 €, which surprises me.

Let's assume that GEA pays 1x sales for Tecsidel (about 14 m€ ?)

EV = 92 (market cap) - 57 (cash) +14 (tecsidel ?) = 49 m€

EV/2014 EBIT = 4

Anyway today's drop leaves me rather cold, because I halved my position this summer/fall after :

- Amiral Gestion announced (this summer I think) that they had sold their position at a loss because they had underestimated the decrease in the toll equipment market in France

- Kapsch relased earlier a rather bleak outlook "no invitations to tender...are in the near vicinity" "strategic adjustments to changed market conditions"

- liquidity was super low

- I was getting scared and unable to remain rational because the position was too big in my portfolio.

I'm prepared to start buying again if price drops to silly levels.

Thank you for the update

RépondreSupprimerGracias por tu trabajo

RépondreSupprimer