Bilan PEA

Ok je suis très très très en retard cette année.

Le PEA finit l'année 2023 à +12%, avec un un minium à -2% en octobre, je suis sauvé par le brutal rebond de fin d'année et l'OPA sur SII.

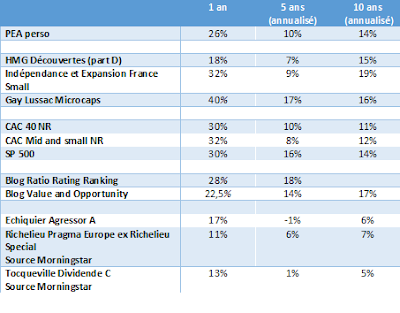

Comparaison par rapport à mes blogs et et gérants favoris : Blog Value and Opportunity 14%, Fonds Indépendance et expansion 12%, HMG Découvertes 8%, Gay Lussac microcaps 6% : ma perf est honnête.

En revanche par rapport aux grands indices (SP500 et CAC40 NR par exemple) c'est une nette sous-performance (les small caps sont une fois de plus délaissées cette année). Je suis également une fois de plus laissé dans la poussière par le blog Ratio Rating Ranking (+25%).

Rappel des années précédentes :

Principales positions : Odet (9%), Precia (8%), une sicav monétaire éligible PEA (AXA PEA régularité) (8%), SII (7%), Gerard Perrier (6%).

Comme l'année dernière peu de mouvements.

Principaux achats en 2023 : LDC, IPSOS, SII et SICAV monétaire (pour être éligible au PEA, cette sicav investit en actions et fait un "swap de performance" pour reproduire le taux monétaire. Un peu trop compliqué à mon goût mais pas le choix en PEA).

Principales ventes : Precia (un petit allègement en début d'année) et Gevelot (idem).

Bilan PME

Pour le PME, on est à +13%.

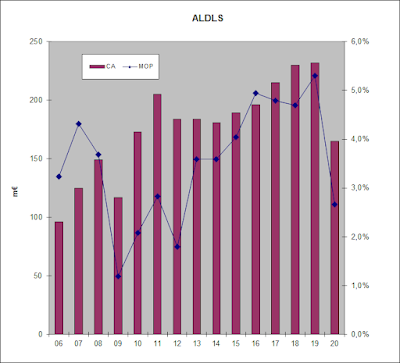

Principales lignes : Groupe Guillin (14%), Adl Partner (nouveau nom Dekuple), 11%, HitechPros (10%), Infotel (9%), DLSI (8%).

Achats 2023 : Infotel, IT Link (renforcements), ESI Groupe (achat opportuniste avant l'OPA finalisée en 2024). Principales ventes : Manutan (OPRO par la famille Guichard)

Commentaires

En fin d'année 2023 la société CIFE a annoncé une OPA simplifiée, suite à la cession par la famille majoritaire de ses parts au groupe Spie Batignolles. C'est la première action dont j'avais parlé dans le blog en février 2011, il y a maintenant presque 13 ans.

SII à également fait l'objet d'une OPA par l'actionnaire majoritaire, suivi d'un retrait obligatoire. J'avais parlé de SII en 2014 dans cet article.

Voilà l'occasion de comparer ces deux investissements, et d'essayer d'en tirer une leçon, en étant prudent sur la portée d'un seul exemple. Plus je passe de temps en bourse, moins j'ai des convictions définitives sur "la" bonne approche.

L'action CIFE était à 58 € en 2011 au moment de l'article, l'OPA se fait à environ 98 € par action (dividendes exceptionnels inclus). En tenant compte des dividendes encaissés, on arrive donc à une magnifique rentabilité de 3% par an, donc proche de 0 en tenant compte de l'inflation.

SII était à environ 4 € en 2014, l'offre est de 70 €. Avec les dividendes encaissés, on est à environ 37% annualisés sur environ 9 ans ! Bien entendu, je n'ai pas réalisé cette performance (j'ai acheté au fur et à mesure, et j'ai stupidement allégé au lieu de ne pas y toucher) mais c'est quand même une belle plus-value.

En termes de coût d'opportunité, mon investissement dans CIFE m'a donc couté cher. Ma patience (certains diront l'entêtement) n'est donc pas récompensée, bien au contraire, 1ère leçon.

Évidement la conclusion est qu'il vaut mieux investir à long

terme dans une société en croissance, que dans une société même très

décotée, sauf si la décote est comblée rapidement. Un aspect totalement négligé dans mon analyse de l'époque.

Un autre aspect était absent de mon analyse de CIFE: dans une société avec un capital entièrement contrôlé comme CIFE, l'actionnaire majoritaire peut avoir bien d'autres objectifs qu'une revalorisation à court terme, voir même l'opposé pour des raisons fiscales.

Il peut généralement se rémunérer indépendamment de la valorisation du cours (dividendes mêmes modestes, salaires, postes d'administrateurs, loyers perçus sur la société, conventions réglementées dans certains cas), et/ou vouloir privilégier par exemple la pérennité ou la transmission de l'entreprise par rapport à l'optimisation à court (ou même à moyen terme) des capitaux engagés. On a vu que CIFE n'a jamais distribué significativement sa trésorerie excédentaire. Pire, les rachats d'actions ont été utilisés par l'actionnaire majoritaire pour se renforcer à bon prix (voir déclarations AMF).

Le contre pouvoir des actionnaires minoritaires ou d'éventuels concurrents (OPA hostile, fonds activiste) est très faible si le capital est entièrement contrôlé.

A contrario pour SII, et sans surprise la croissance à long terme a un impact énorme sur la valeur ; SII aurait pu être achetée bien plus cher que les 4€ et EV/ROP de 5x payés en 2014, et la performance aurait été néanmoins excellente.

Rétrospectivement mon prix d'achat état ridiculement faible, probablement le contre coup de la crise de 2008 et de la crise de l'euro en 2010-2012. On a donc eu un "double effet kiss cool" : croissance des résultats ET du multiple de valorisation. On a exactement le cas inverse quand une société de croissance descend brutalement de son piedestal.

A l'inverse de CIFE, SII a bénéficié d'une situation favorable: marché des services informatiques en croissance, fragmenté, et ou les petits acteurs peuvent croitre (pas de situation "winner takes all"). Je ne veux pas non plus minimiser le talent du management, qui a su accélérer cette croissance notamment à l'étranger et notamment en Pologne dans le cas de SII.

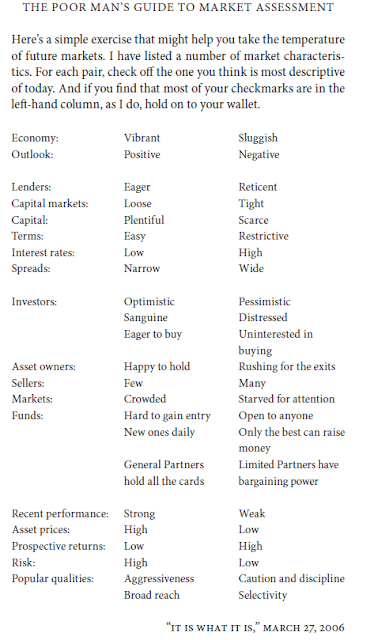

Bref mon explication commence à devenir laborieuse, mais il est clair que mon approche deep value à la Graham (on regarde principalement le bilan ou le prix de l'action par rapport à ses résultats passés, sans trop se soucier de la croissance qui de doutes manières est impossible à prévoir, ni de la qualité du management) a pas mal évolué.

Je n'ai pas pourtant pas (encore) complètement basculé dans le camp "Warren Buffet" (buying wonderful companies at a fair price).

Je ne pense pas que SII avait en 2014 ou a maintenant des avantages

concurrentiels par rapport à ses concurrents dans le secteur des ESN.

Les sociétés comparables (je pense à Neurones) ont eu un parcours assez

comparable, bien qu'avec une croissance moins spectaculaire.

Je reste également sceptique sur la possibilité (ou en tout cas mes capacités) de prédire (façon Warren Buffet ou Munger, 100-baggers, etc...) une croissance à long terme, en analysant les critères qualitatifs biens connus ("moat", avantage concurrentiel durable, pricing power, secteur avec une grande visibilité sur la croissance future, etc...).

Mais l'exemple de SII montre qu'on peut avoir un beau 10 bagger sans nécessairement trouver le prochain Coke, Apple ou LVMH