The presentation slides are interesting to get an idea of GEA business.

Previous posts on GEA: here and here.

The stock went up sharply today (+15%, 88.4 €).

A few comments

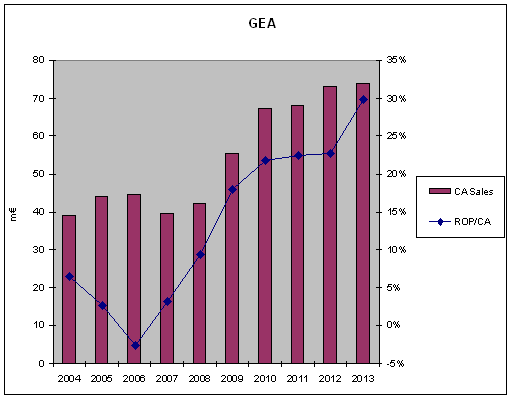

Sales are flat ; EBIT margin (operational margin to be precise) is up but GEA warns that it is exceptional and linked to the end of several contracts.

The drop in backlog orders has -so far- not materialized itself. There's nothing in the press release or in the slides hinting at a future drop in sales ; the management insists on its export recent contracts. GEA does not seem to be much affected by the Ecotaxe Snafu.

The cash is boosted by a reduction of the working capital that was already apparent in the 2013HY accounts ; so again a one-off effect.

True to itself the management has decided to keep the cash to "stay independent" and "finance its investments and exports". However the dividend is up 40% (3.35 €/share).

The family owns 38 % of the capital. Michel Baule, an entrepreneur in polymers turned small caps investor, owns 15%. I see his presence (strong minority investor) as a positive development.

With 60 m€ net cash for a 106 m€ market cap, EV/2013 EBIT ~ 2 !

I see no excuse not to buy some more (and I did at the opening this morning).

A look at competitor Kapsch :

I did not spent enough time on this, but from what I understand the project-related part of the business can be quite volatile (problems in Poland and South Africa legal issues). So a good reminder that a mindless extrapolation of the past performance is dangerous...I guess it applies to GEA also.

Aucun commentaire:

Enregistrer un commentaire