I own some shares of Nexeya (ALNEX), bought between 5 and 8 € in 2012.

I never made a post on Nexeya but Nate at oddballstocks did.

Nexeya is currently making a tender offer at 12 € for minority shareholders.

Nexeya released yesterday the details on its offer (link, in French only I fear), at the same time as its 2013 financial accounts.

It's interesting to look at the offer for 2 reasons :

- the actual decision to sell or not,

- it's very instructive to look at the independant expert valuation and methodology, to improve mine but also to have an idea about what to expect in future comparable buyouts.

The document is 76 pages long, I'll try to make a shorter post !

The independent expert is a member of Crowe Horwath network.

The independant expert uses DCF and comparables analysis.

Any approach based on book value is judged irrelevant by the expert for a company like Nexeya. The offer values Nexeya on a P/B ~0.7 (based on 2013 HY accounts) or P/B~0.9 (based on 2013 final accounts, after a ~20 goodwill depreciation has conveniently depressed book value).

1st lesson: never assume that the minimum buyout offer will be at book value (even for a company that's been profitable for the last 7 years, median ROE~10 %).

DCF analysis

I show only the final table:

The main hypothesis built into this model are :

Cost of capital 12.2 % (based on WACC stuff :link); I routinely use 12 % as my "base rate". So no bad surprises here.

Projected EBIT margin 7.3 %, which is more that the average past margins and 2010 peak margin at 7.1 %. So again a slightly optimistic but reasonnable assumtion.

Modest future growth, again a reasonable assumption.

Then comes net debt :

3.2 m€ for apparently unfunded pension liabilities (after taxes), a good reminder to not forget those in my own evaluation.

However, if we have a look at the most recent published accounts (annual accounts, June 2013), and if I'm not mistaken

short term debt 5.2 m€, LT debt 7.6 m€, cash 16.0 m€ => excess cash 3.2 m€ vs

1.1 net debt according to the independant expert !!!!!!

Where did all this cash go in just 3 months ?

I have not found the answer. I suspect that it is used to finance the buyout, thus depressing the tender offer price. Neat, isn't it ?

Correcting for this only, without changing the rest, would make the DCF estimate go from 12.5 €/share to around 13.5 €/share.

Comparable companies

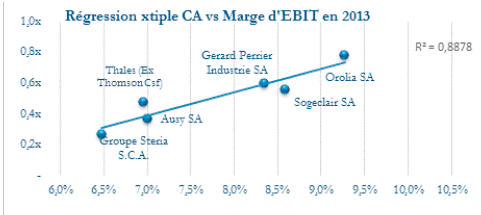

This graph plots EV/Sales vs EBIT margin, using 2013 expected results.

You can always discuss if the companies are actually comparable (Steria provides information technology services, not quite close to Nexeya), but that's not the point.

Based on this "regression analysis", and Nexeya 7.3 % EBIT margin, the expert computes a "fair"value for Nexeya.

Then, because Nexeya is a smaller company than the mean of the sample used here, the expert applies a 15 % discount on this :

No fundamental reason other than an empirical observation on market cap size effect on valuation.

Let's have a look at the comparables market cap

This one reminds me of the "Bill Gates walks into a bar" example about the distinction between

the mean and the median value of sample. With Thales in the sample, we can be quite sure that Nexeya market cap is smaller than the mean.

Another issue (but I don't feel like going on, it is late) are the projected results/margins used for the comparables ; I checked some and I found significant discrepancies between projected and actual known 2012 data, often leading to a higher projected price for Nexeya "fair" price.

Conclusion

I've not made up my mind yet. I need to cool down a little.

This confirms my first impression about a lowball offer.

However I'm not sure I want to stay invested in a company where the managers interests are evidently not aligned with mine, and maybe severe liquidity issues in the future. Besides, I'm not sure if there is some dilution around the corner or not.

I want to make some further observations.

Given the path of Nexeya stock price (IPO at around 17 €, buyout at 12 € ~seven years later), this reinforces my rule of thumb to never participate to an IPO, which is a pity because I view it as one of the few useful functions of the stock market for the "real" economy.

This also justifies why you need a large margin of safety compared to a "fair price", maybe even more so for small caps maybe given this kind of tender offers, especially when no strong minority investor (independent mutual fund, activist shareholder,...) is present at the capital.

Belle article , j'aime ton blogg , ils faut poster plus des articles :) et des nouvelles idees ;)

RépondreSupprimer